Points forts

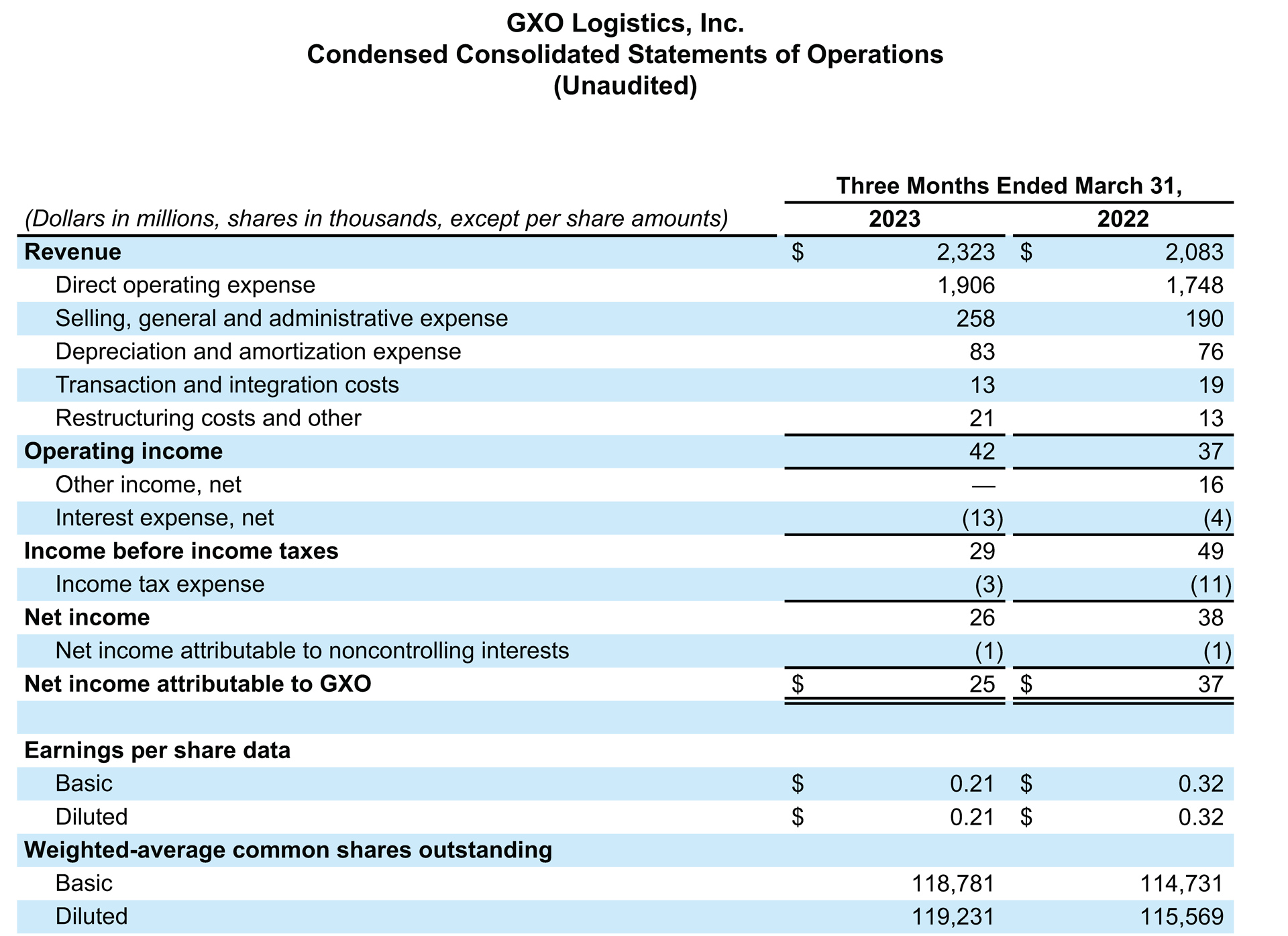

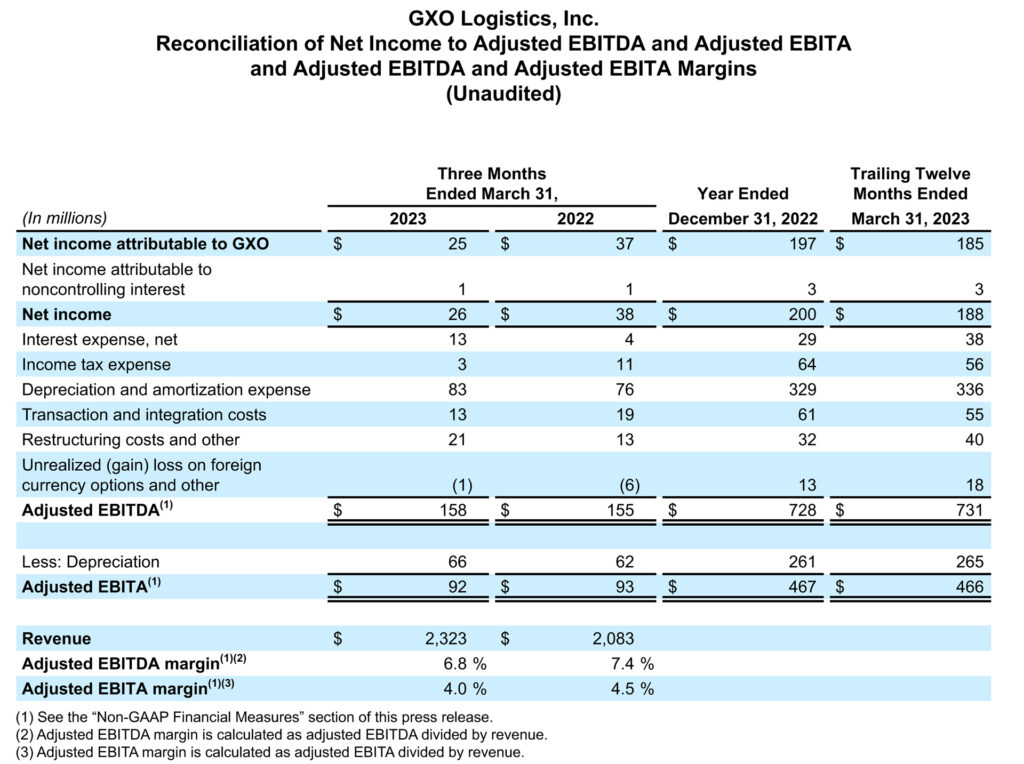

- Record first quarter revenue of $2.3 billion, up 12% year over year; organic revenue growth1 of 7%; net income attributable to GXO of $25 million; adjusted EBITDA1 of $158 million; diluted EPS of $0.21 and adjusted diluted EPS1 of $0.49

- Full-year 2023 profit guidance raised:

- Adjusted diluted EPS raised $0.10, now expected to be $2.40-$2.60

- Adjusted EBITDA raised $15 million, now expected to be $715-$745 million

Business Highlights

- Sales pipeline grows to approximately $2.3 billion, up from fourth quarter 2022

- Strong first half momentum in new wins, including signing GXO’s largest-ever annual revenue contract

- Incremental 2023 revenue of $782 million secured through the first quarter

- Revenue retention rate remains in the mid-to-high 90s

- First quarter e-commerce revenue up 34% year over year; reverse logistics revenue up 50% year over year

- Record operational tech deployment, up 64% year over year

- Expanded GXO Direct product to UK; rollout to Continental Europe planned later this year

GXO Logistics, Inc. (NYSE: GXO) today announced results for the first quarter 2023.

Malcolm Wilson, Chief Executive Officer of GXO, said, “We’ve had a great start to the year, with strong top- and bottom-line results showcasing the strength and predictability of our business. In the first quarter, we delivered record revenue of $2.3 billion, up 12 percent year over year; $25 million of net income attributable to GXO; and $158 million of adjusted EBITDA, reflecting stellar operational performance.

“We’ve kicked off the year by signing exciting new partnerships and expanding relationships across multiple verticals and markets, with several transformative projects coming to fruition. Our new project with Sainsbury’s, a leading grocery retailer in the UK, is the largest annual revenue contract awarded in GXO’s history and represents nearly $1 billion in lifetime value. Through the end of April, we’ve secured over $800 million of incremental revenue for 2023, while bringing our pipeline to a near-record level.

“We saw increased outsourcing and automation in the quarter. Operational tech was up a record 64 percent year over year, and we are accelerating our deployment of artificial intelligence, which boosts productivity significantly. We also continued to make strong progress on our key initiatives: we are seeing the benefits of our central efficiencies program sooner than expected, and the integration of Clipper is largely complete, allowing GXO to accelerate the expansion of GXO Direct, our industry-leading shared-user solution, to the UK.

“Our first quarter performance, strong wins, growing pipeline, and excellent execution put us squarely on track for achieving our raised 2023 guidance and delivering our 2027 targets. It’s an exciting year, and we see significant opportunity to take share and grow our business.”

First Quarter 2023 Results

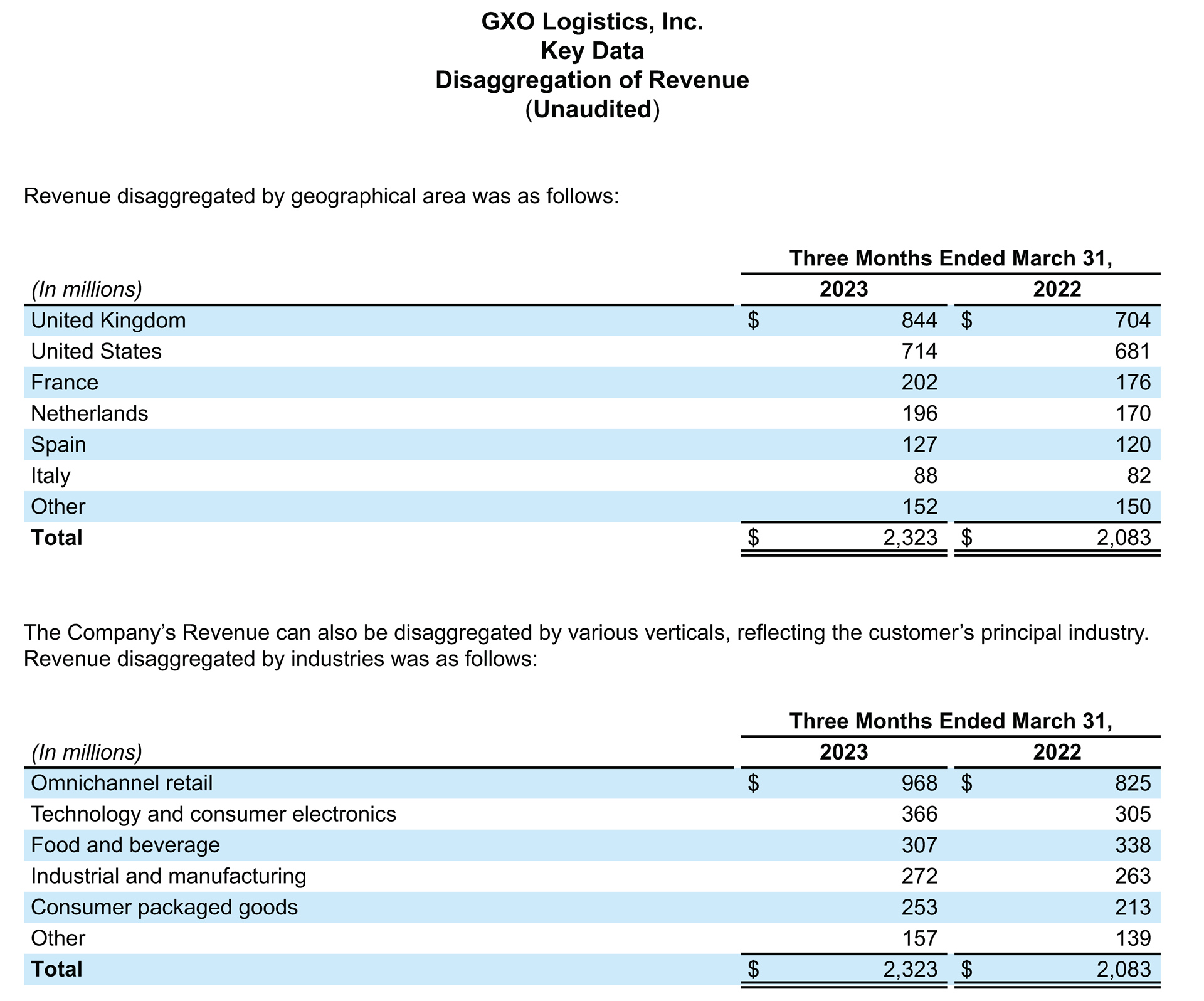

Revenue increased to $2.3 billion, up 12% year over year compared with $2.1 billion for the first quarter 2022. Organic revenue grew by 7%.

Operating income increased to $42 million, up 14% year over year compared with $37 million for the first quarter 2022.

Reflecting the impact of non-operational items, including foreign exchange rates, interest expense, and reduced pension income, net income attributable to GXO was $25 million, compared with $37 million for the first quarter 2022. Diluted earnings per share was $0.21, compared with $0.32 for the first quarter 2022.

Adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA1”) increased to $158 million from $155 million in the first quarter 2022.

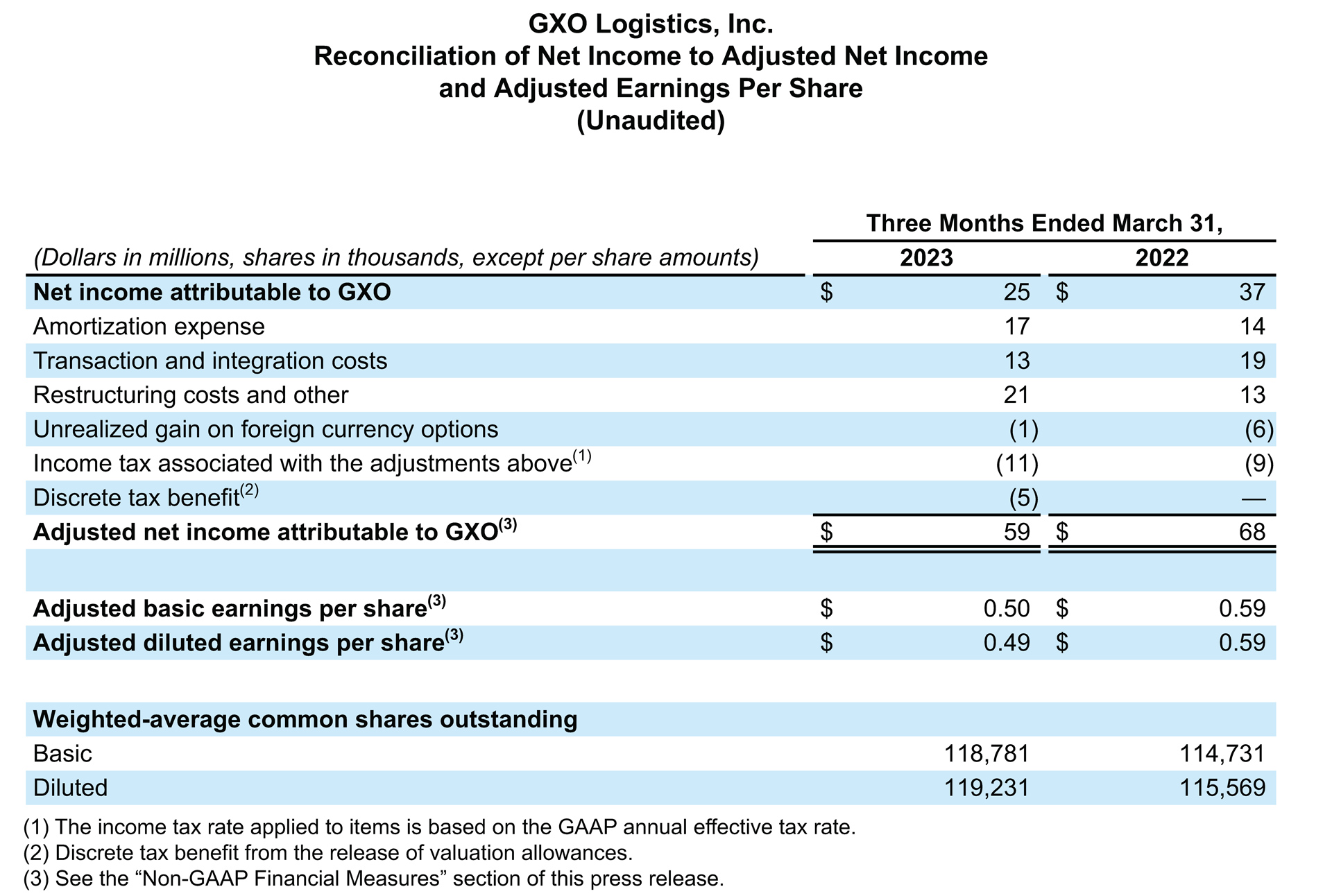

Adjusted net income attributable to GXO1 was $59 million, compared with $68 million for the first quarter 2022. Adjusted diluted earnings per share1 was $0.49, compared with $0.59 for the first quarter 2022.

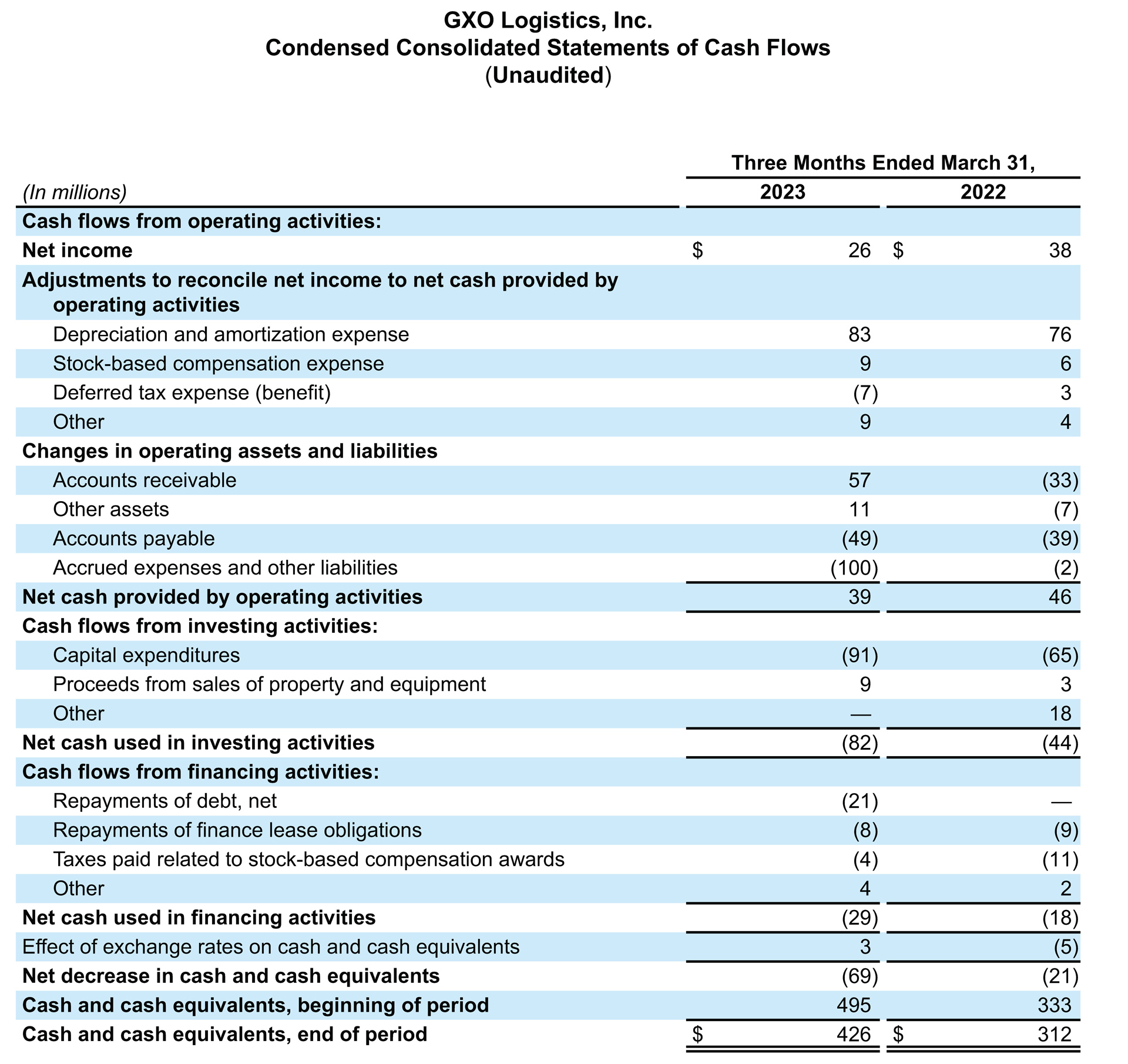

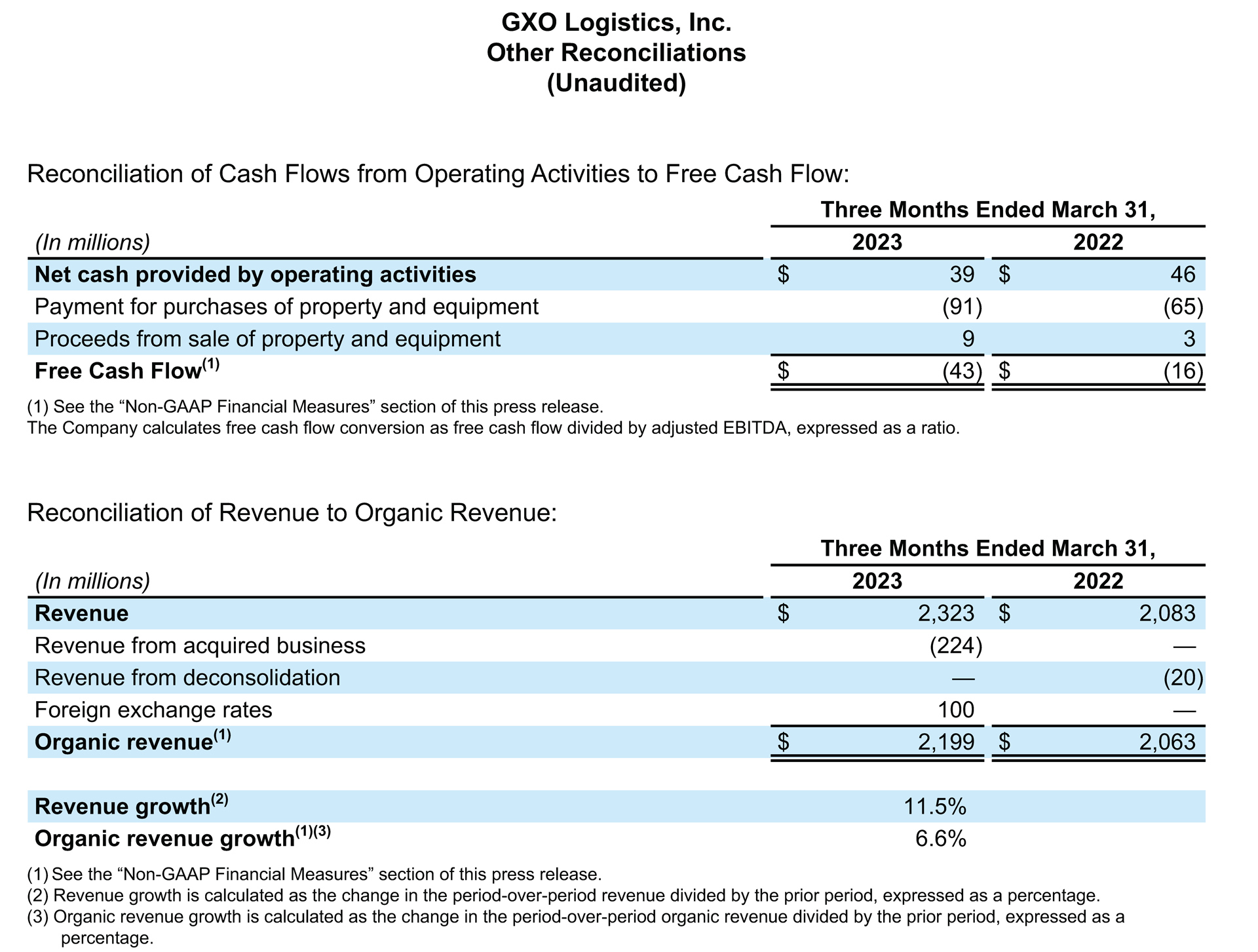

GXO generated $39 million of cash flow from operations, compared with $46 million for the first quarter 2022. In the first quarter of 2023, GXO used $43 million of free cash flow1 compared to $16 million for the first quarter 2022, reflecting typical seasonality.

Cash Balances and Outstanding Debt

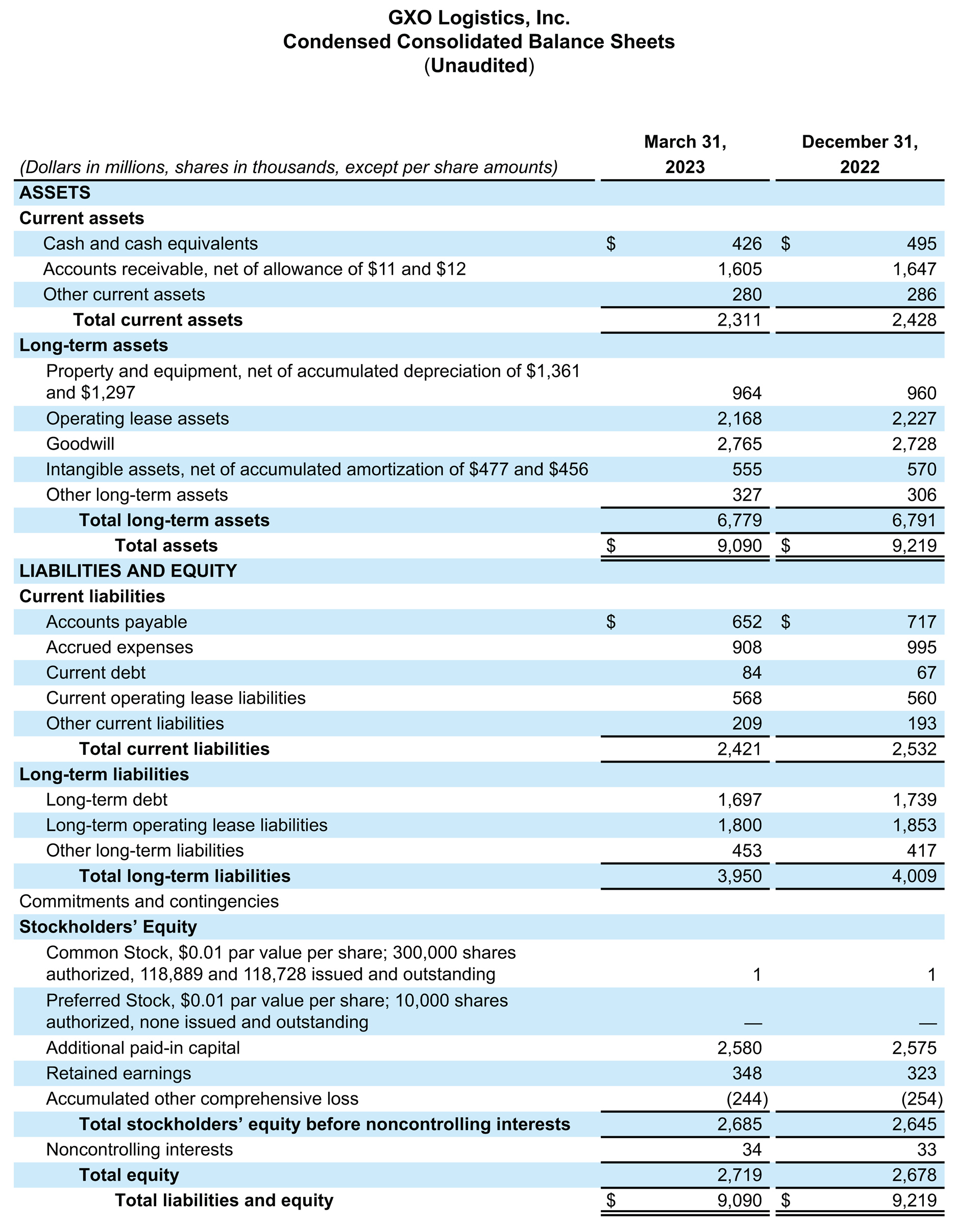

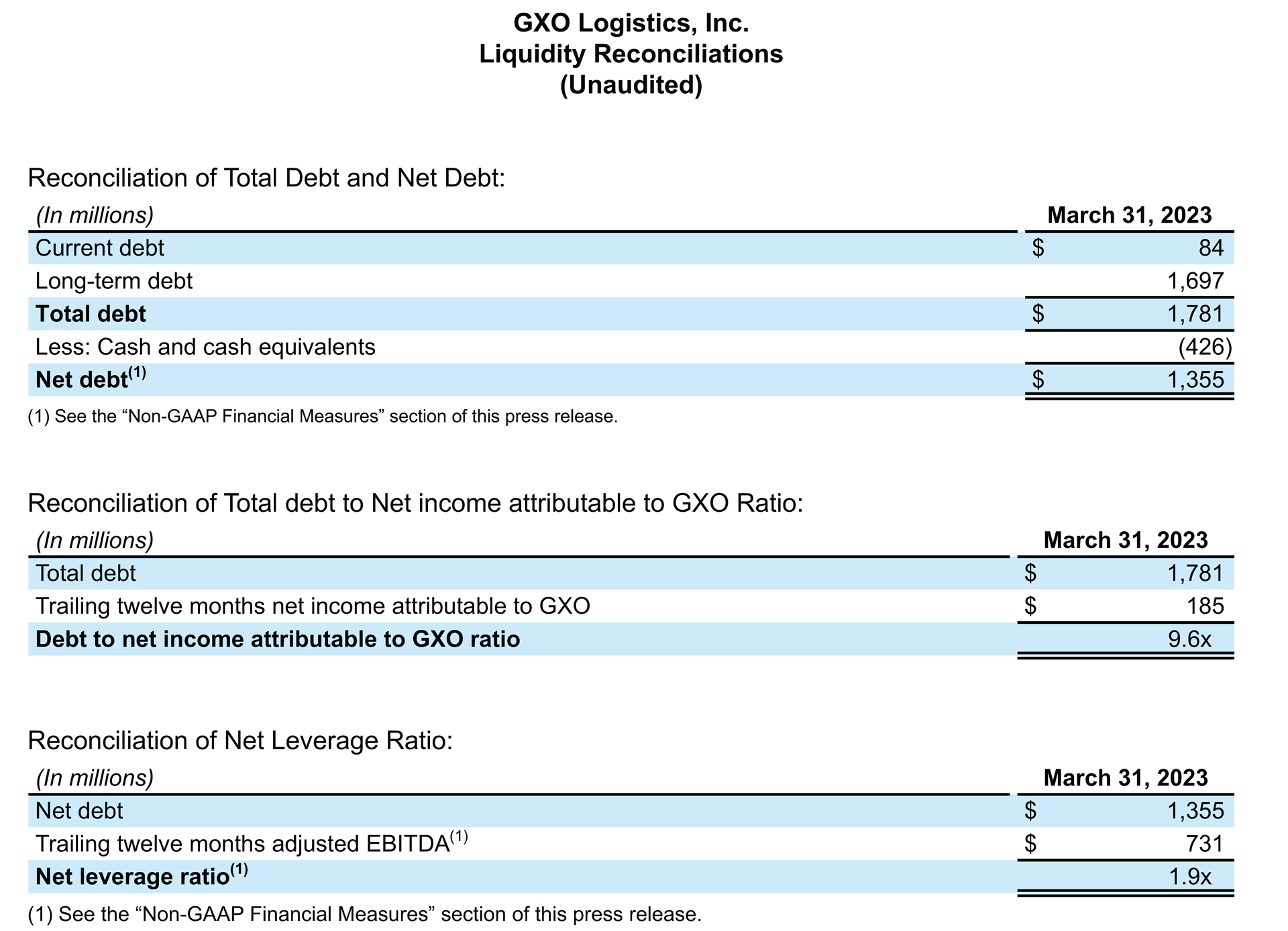

As of March 31, 2023, cash and cash equivalents and debt outstanding were $426 million and $1,781 million, respectively, as part of GXO’s investment grade balance sheet.

2023 Guidance

GXO’s current 2023 financial outlook is as follows:

- Organic revenue growth1 of 6% to 8%;

- Adjusted EBITDA1 of $715 million to $745 million (raised from $700 million to $730 million);

- Free cash flow1 conversion of approximately 30% of adjusted EBITDA1; and

- Adjusted diluted earnings per share1 of $2.40 to $2.60 (raised from $2.30 to $2.50).

- For definitions of non-GAAP measures see the “Non-GAAP Financial Measures” section in this press release.

Conférence téléphonique

GXO will hold a conference call on Wednesday, May 10, 2023, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 877-407-8029; international callers dial +1 201-689-8029. Conference ID: 13737653. A live webcast of the conference will be available on the Investor Relations area of the company’s website, investors.gxo.com. The conference will be archived until May 24, 2023. To access the replay by phone, call toll-free (from US/Canada) 877-660-6853; international callers dial +1 201-612-7415. Use participant passcode 13737653.

A propos de GXO Logistics

GXO logistics, Inc. (NYSE : GXO) est le plus grand prestataire pure-player de logistique contractuelle au monde et bénéficie de la croissance rapide du e-commerce, de l'automatisation et de l'externalisation. GXO s'engage à fournir un environnement de travail diversifié de niveau international à ses 130 000 collaborateurs répartis sur 970 sites totalisant une surface d’environ 18,5 millions de mètres carrés d’entreposage. L'entreprise collabore avec des clients d’envergure internationale pour relever des défis logistiques complexes grâce à des solutions technologiquement avancées et des solutions pour le e-commerce à grande échelle et d’implémentation rapide. Le siège social de GXO est situé à Greenwich, dans le Connecticut, aux États-Unis. Rendez-vous sur GXO.com pour plus d’informations, et suivez GXO sur LinkedIn, Twitter, Facebook, Instagram et YouTube.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this release.

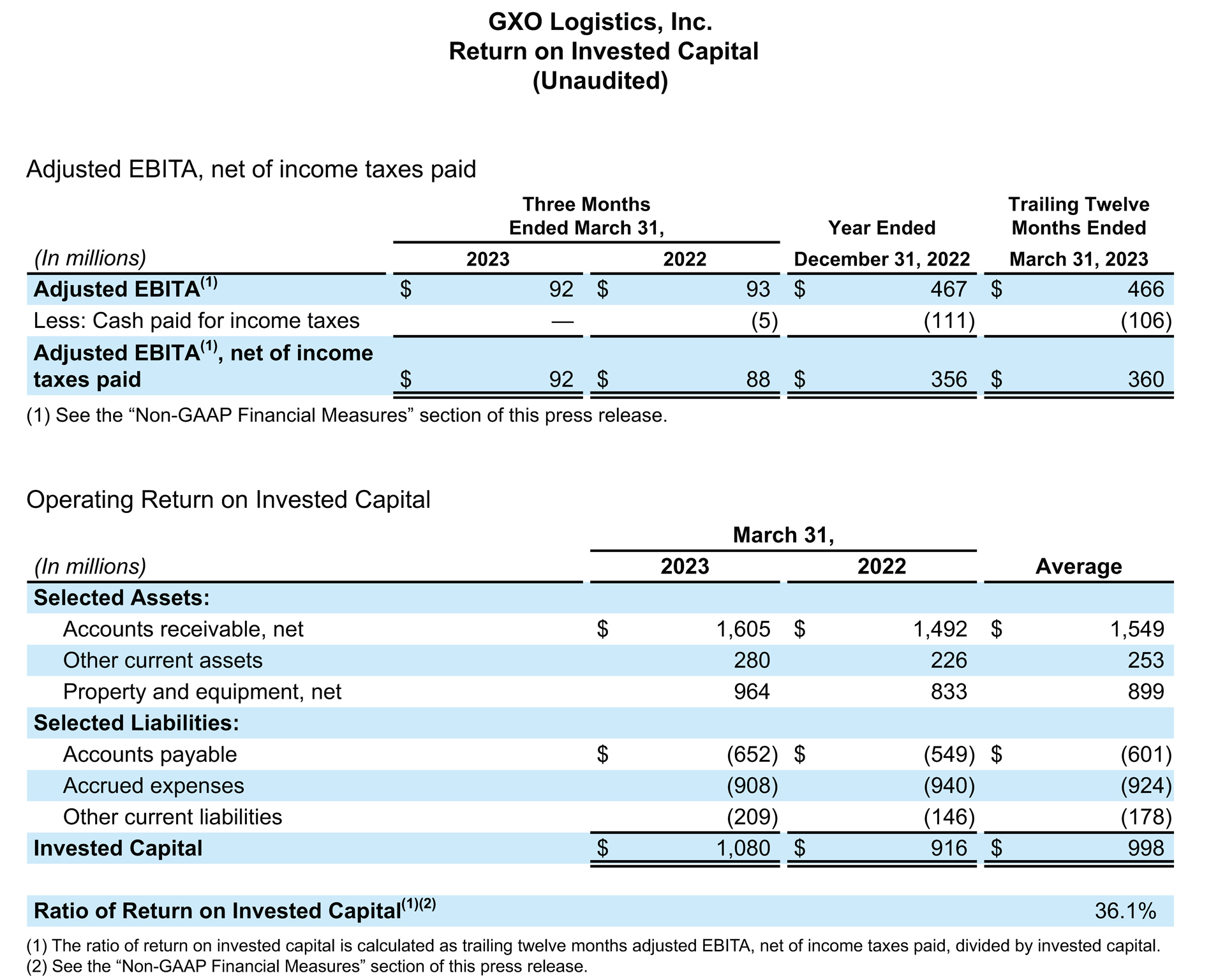

GXO’s non-GAAP financial measures in this press release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), adjusted EBITDA margin, adjusted earnings before interest, taxes and amortization (“adjusted EBITA”), adjusted EBITA, net of income taxes paid, adjusted EBITA margin, adjusted net income attributable to GXO, adjusted earnings per share (basic and diluted) (“adjusted EPS”), free cash flow, organic revenue, organic revenue growth, net leverage ratio, net debt, and return on invested capital (“ROIC”).

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, GXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. GXO’s non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted EBITA, adjusted net income attributable to GXO and adjusted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the financial tables below. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition or divestiture and may include transaction costs, consulting fees, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and separating IT systems. Restructuring costs primarily related to severance costs associated with business optimization initiatives.

We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as net cash provided by operating activities less payment for purchases of property and equipment plus proceeds from sale of property and equipment.

We believe that adjusted EBITDA, adjusted EBITDA margin, adjusted EBITA, adjusted EBITA, net of income taxes paid, and adjusted EBITA margin, improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses.

We believe that adjusted net income attributable to GXO and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains, which management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets.

We believe that organic revenue and organic revenue growth are important measures because they exclude the impact of foreign currency exchange rate fluctuations, revenue from acquired businesses and revenue from deconsolidated operations.

We believe that net leverage ratio and net debt are important measures of our overall liquidity position and are calculated by removing cash and cash equivalents from our total debt and net debt as a ratio of our adjusted EBITDA. We calculate ROIC as our adjusted EBITA, net of income taxes paid divided by invested capital. We believe ROIC provides investors with an important perspective on how effectively GXO deploys capital and use this metric internally as a high-level target to assess overall performance throughout the business cycle.

Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating GXO’s ongoing performance.

With respect to our financial targets for full-year 2023 organic revenue growth, adjusted EBITDA, free cash flow, and adjusted diluted EPS, a reconciliation of these non-GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non-GAAP target measures. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statements of income and cash flows prepared in accordance with GAAP, that would be required to produce such a reconciliation.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements, including our full year 2023 financial targets of organic revenue growth, adjusted EBITDA, free cash flow, adjusted diluted earnings per share, the expected incremental revenue in 2023 from new customer wins in 2023, and continued strong performance in 2023 and delivery of our 2027 targets. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by the company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors the company believes are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, the risks discussed in our filings with the SEC and the following: the impact of the COVID-19 pandemic; economic conditions generally; supply chain challenges, including labor shortages; our ability to align our investments in capital assets, including equipment, and warehouses, to our customers’ demands; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; unsuccessful acquisitions or other risks or developments that adversely affect our financial condition and results; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our indebtedness; our ability to raise debt and equity capital; litigation; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers’ facilities and efforts by labor organizations to organize our employees; risks associated with defined benefit plans for our current and former employees; our inability to attract or retain necessary talent; the increased costs associated with labor; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; seasonal fluctuations; issues related to our intellectual property rights; governmental regulation, including environmental laws, trade compliance laws, as well as changes in international trade policies and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; natural disasters, terrorist attacks or similar incidents, including the conflict between Russia and Ukraine; a material disruption of the company’s operations; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; the impact of potential cyber-attacks and information technology or data security breaches; the inability to implement technology initiatives successfully; our ability to achieve our Environmental, Social and Governance goals; and a determination by the IRS that the distribution or certain related spin-off transactions should be treated as taxable transactions.

All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

Contacts

Click here to download this press release in PDF format.