Belangrijke prestaties

- Fourth quarter revenue of $2.6 billion; net income attributable to GXO of $73 million; adjusted EBITDAi of $193 million; diluted EPS of $0.61 and adjusted diluted EPSi of $0.70

- Full year revenue of $9.8 billion; net income attributable to GXO of $229 million; adjusted EBITDAi of $741 million; diluted EPS of $1.92 and adjusted diluted EPSi of $2.59

- Full year cash flows from operations of $558 million, equivalent to 244% of net income attributable to GXO, and free cash flowi of $302 million; equivalent to 41% of adjusted EBITDAi

- Announced 2024 guidance2:

- Organic revenue growthi of 2%-5%

- Adjusted EBITDAi of $760-$790 million

- Adjusted diluted earnings per sharei of $2.70-$2.90

- Free cash flow conversioni of 30%-40% of adjusted EBITDAi

Business Highlights

- Signed more than $1 billion annualized revenue in 2023; ~40% from outsourcing

- ~$600 million of incremental revenue booked for 2024, and ~$230 million of additional incremental revenue booked for 2025; 29% higher than last year

- Sales pipeline remains strong at approximately $2 billion

- Closed the acquisition of PFSweb on October 23, 2023

GXO Logistics, Inc. (NYSE: GXO) today announced results for the fourth quarter and full year 2023.

Malcolm Wilson, Chief Executive Officer of GXO, said, “In the fourth quarter, we delivered a successful operational peak for our customers, capping off what was a truly great year for GXO.

“In 2023, GXO delivered strong growth in revenue, net income and adjusted EBITDA, as well as record cash flows from operations and free cash flow, and a stellar return on invested capital. We closed a tremendous $1 billion of annualized new business wins, with nearly 40% coming from outsourcing as more companies look to GXO to transform their supply chains. Through our acquisition of PFS, we welcomed over 100 fantastic brands in high-growth verticals, and we are now focused on supercharging PFS’ growth.

“During the year, GXO continued to lead the industry in automation, deploying a record amount of robotics and winning multiple long-term, highly automated contracts with global blue-chip companies. These companies are looking to GXO for continued innovation, and we anticipate the proliferation of AI and automation deployment across our operations to accelerate in 2024 and beyond.

“We’re uniquely positioned to help our customers make their supply chain operations more productive today and more resilient tomorrow. Our 2024 guidance reflects another year of solid revenue growth as well as continued strength in profit and cash flow, and we are very excited about our long-term growth trajectory.”

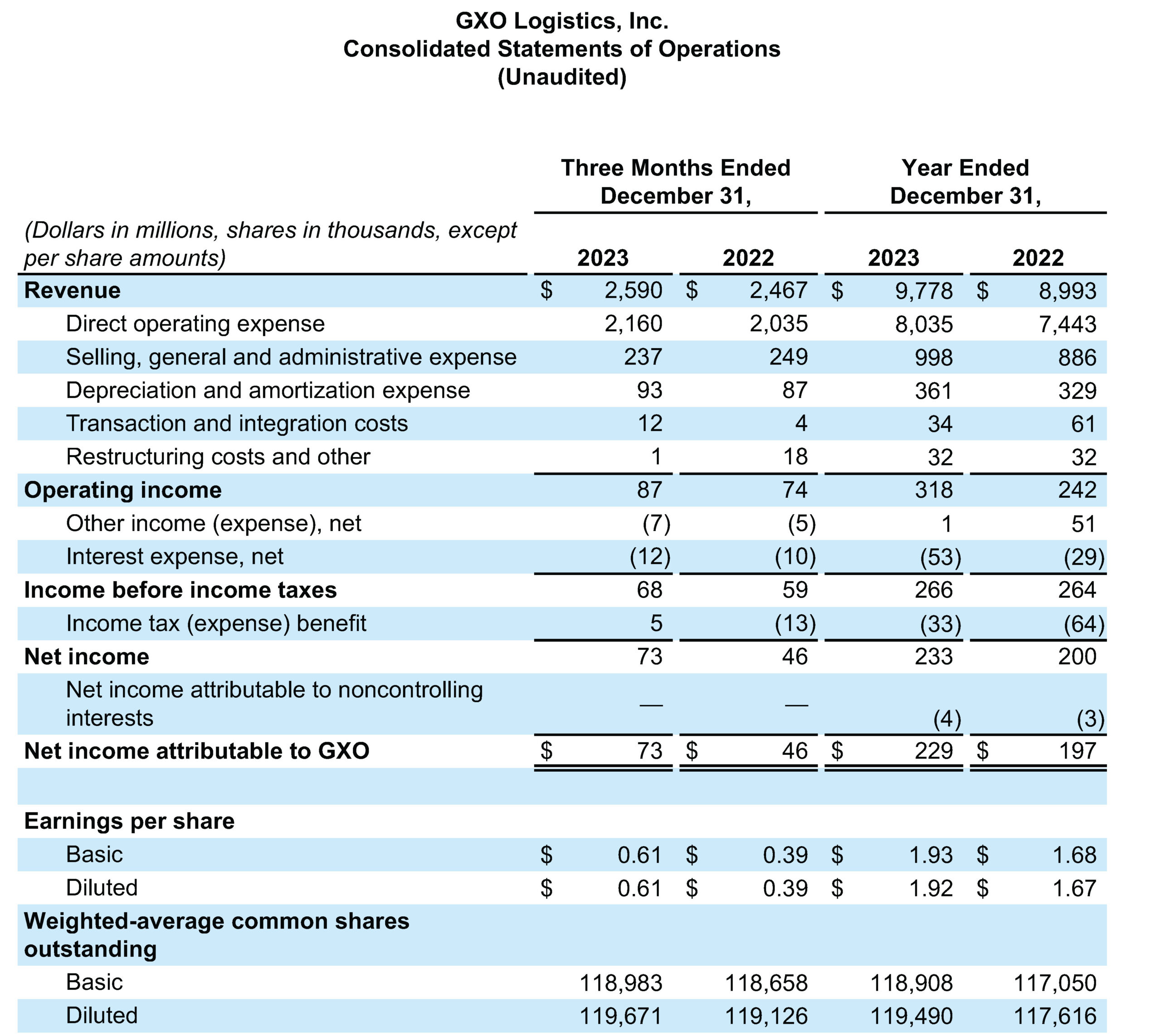

Fourth Quarter 2023 Results

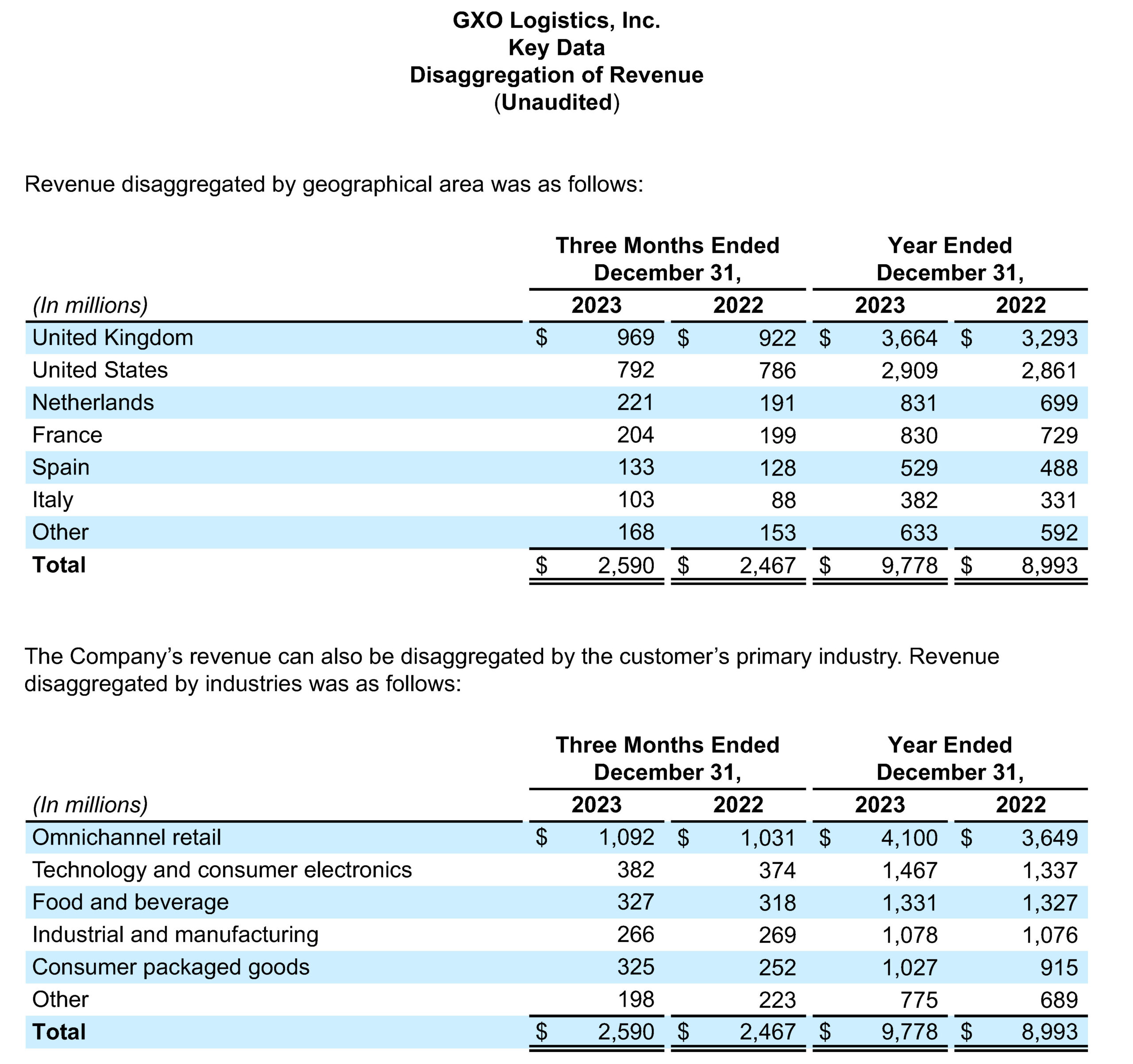

Revenue increased to $2.6 billion, compared with $2.5 billion for the fourth quarter 2022.

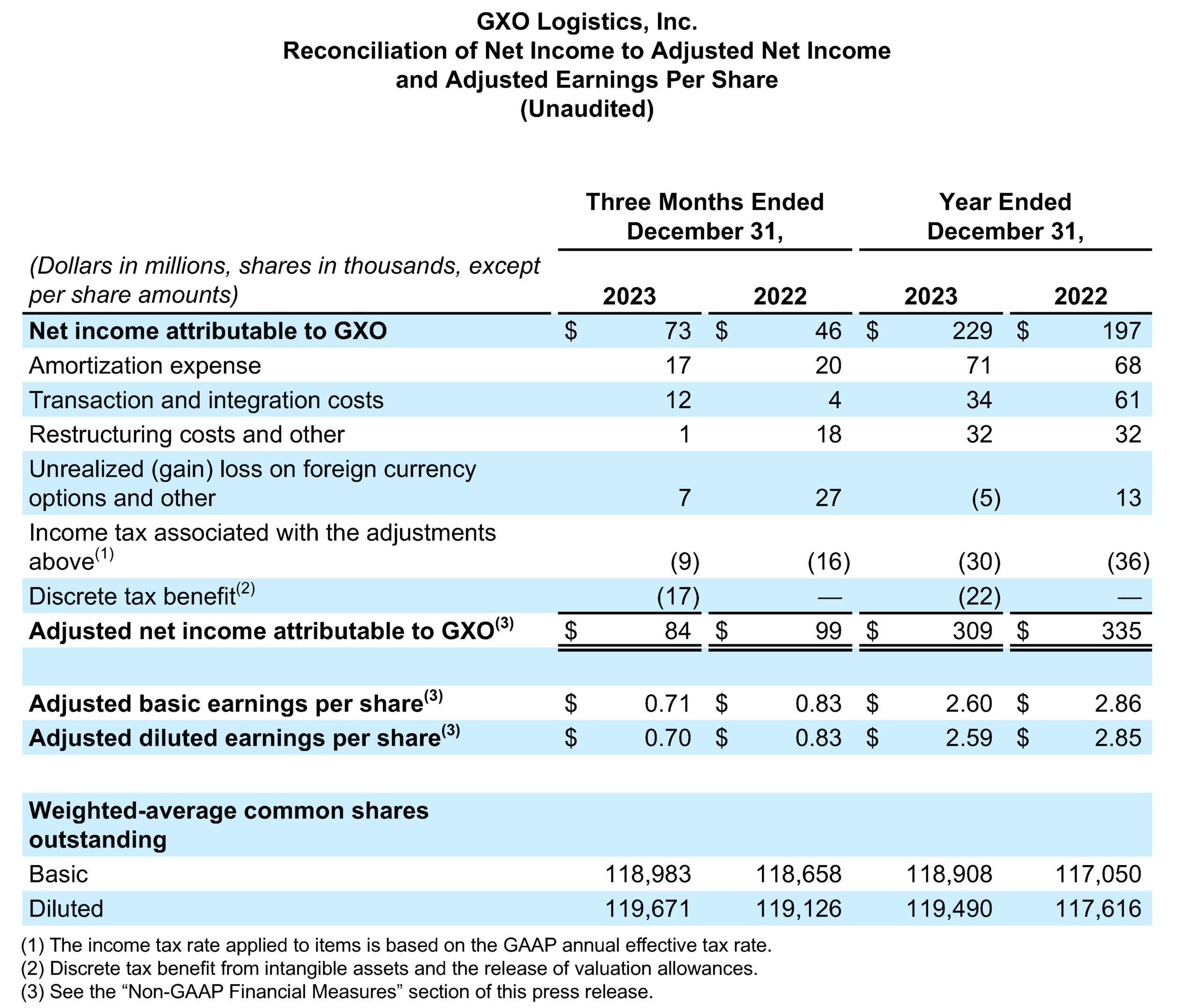

Operating income increased to $87 million, compared with $74 million for the fourth quarter 2022. Net income attributable to GXO increased to $73 million, compared with $46 million for the fourth quarter 2022. Diluted earnings per share increased to $0.61, compared with $0.39 for the fourth quarter 2022.

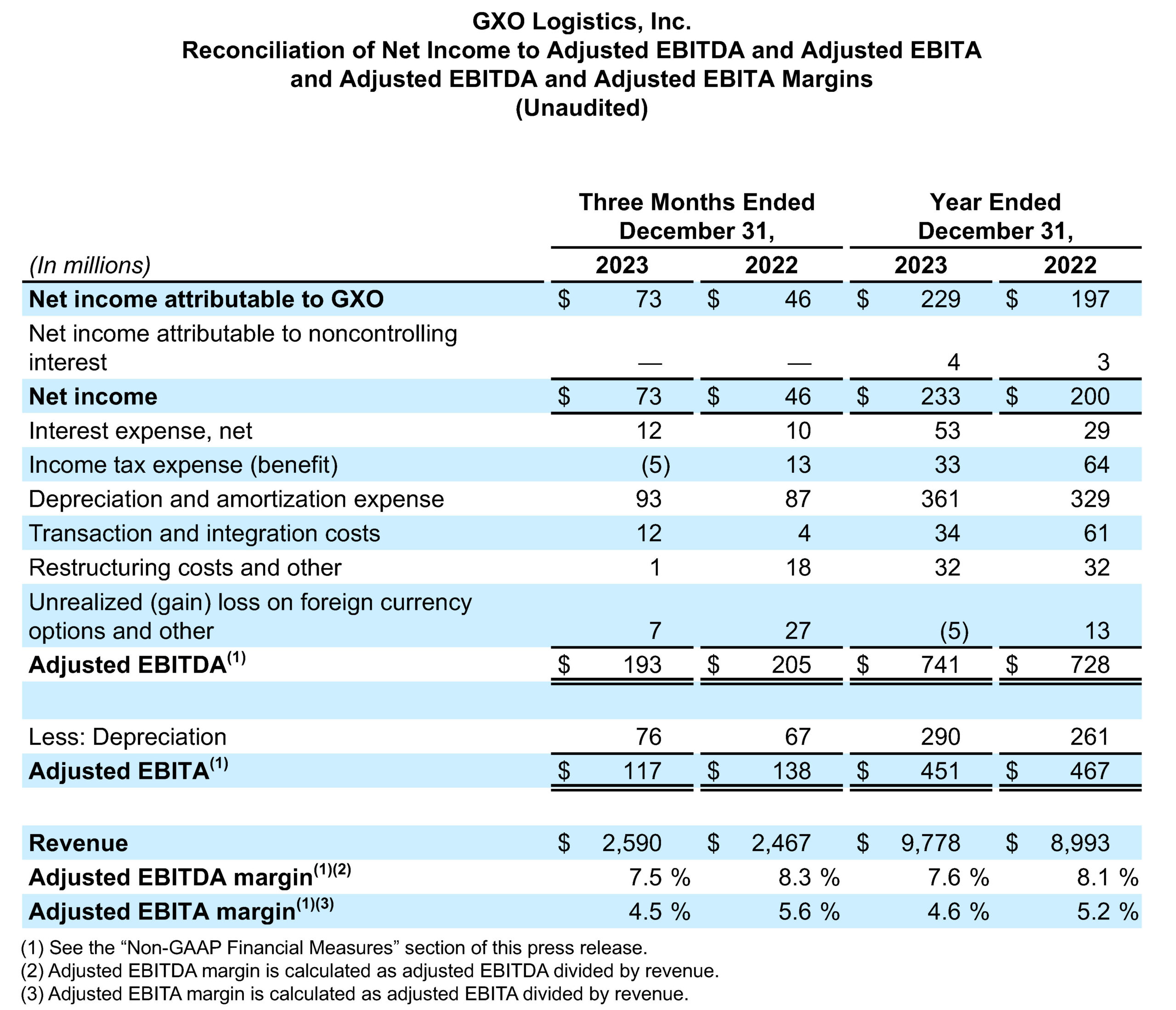

Adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDAi”) was $193 million, compared with $205 million for the fourth quarter 2022. Adjusted net income attributable to GXOi was $84 million, compared with $99 million for the fourth quarter 2022. Adjusted diluted earnings per sharei was $0.70, compared with $0.83 for the fourth quarter 2022.

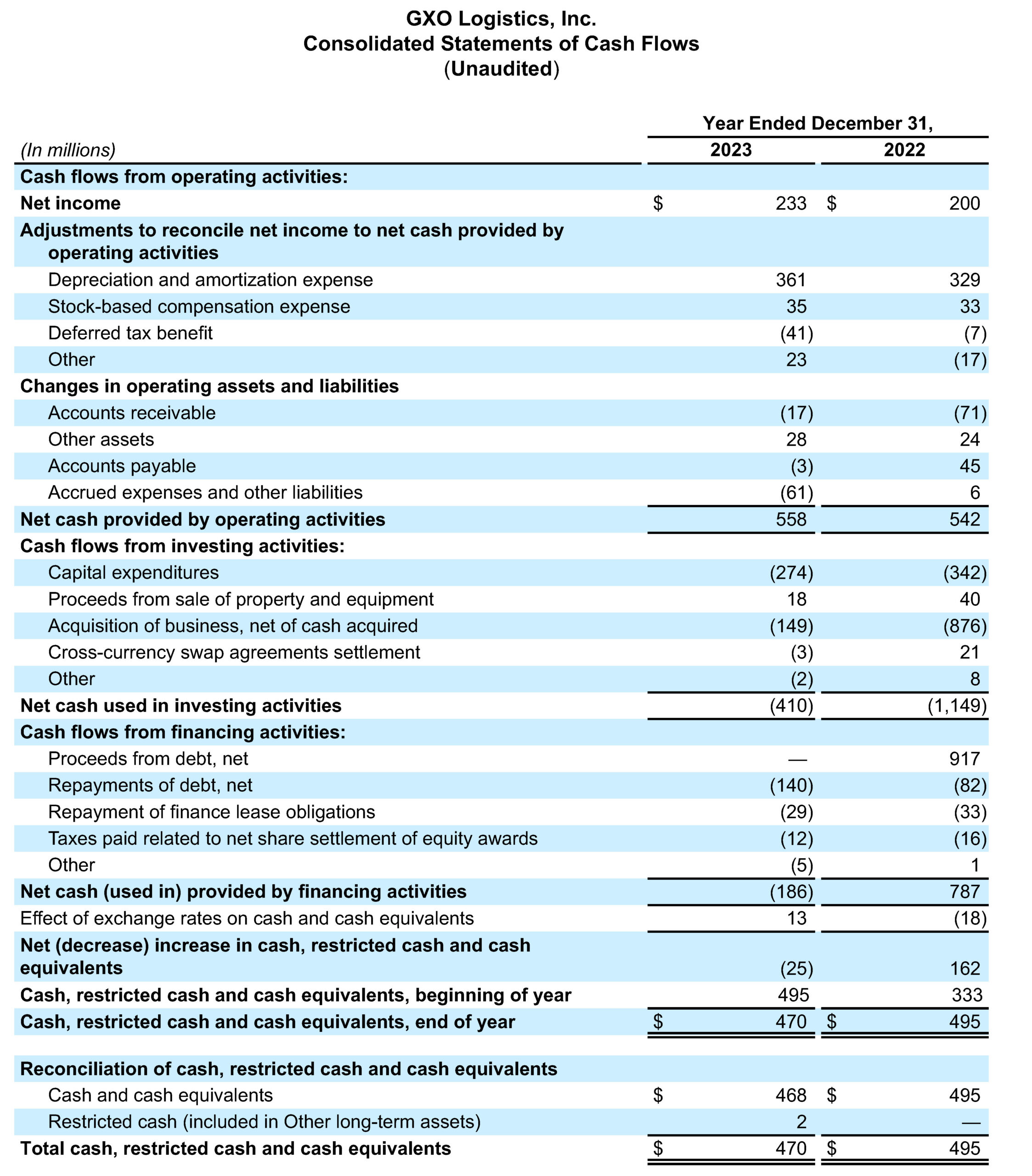

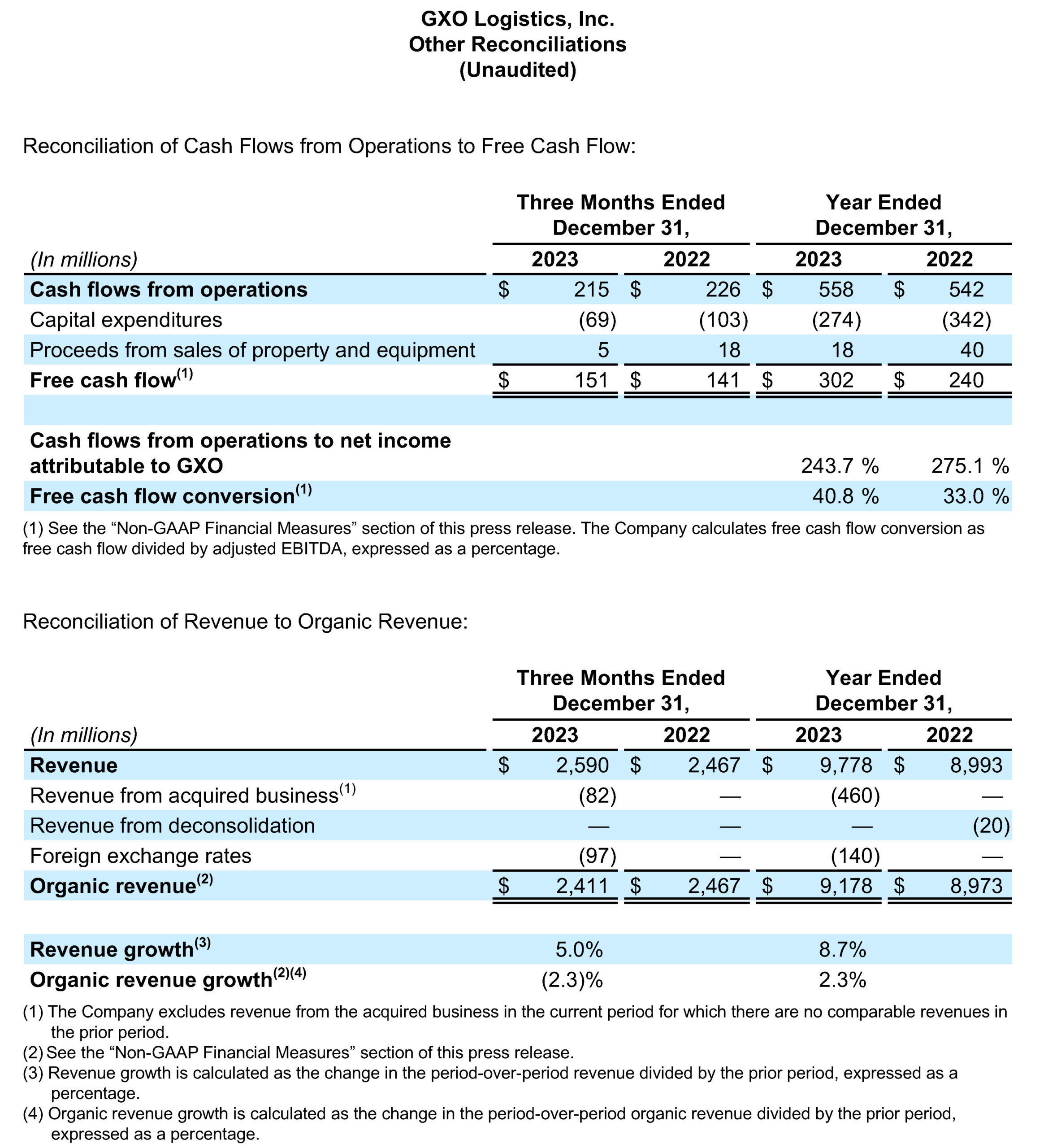

GXO generated $215 million of cash flows from operations, compared with $226 million for the fourth quarter 2022. In the fourth quarter of 2023, GXO generated $151 million of free cash flowi, compared with $141 million for the fourth quarter 2022.

Full Year 2023 Results

Revenue increased to $9.8 billion, compared with $9.0 billion for 2022.

Operating income increased to $318 million, compared with $242 million for 2022. Net income attributable to GXO increased to $229 million, compared with $197 million for 2022. Diluted earnings per share increased to $1.92, compared with $1.67 for 2022.

Adjusted EBITDAi increased to $741 million, compared with $728 million for 2022. Adjusted net income attributable to GXOi was $309 million, compared with $335 million for 2022. Adjusted diluted earnings per sharei was $2.59, compared with $2.85 for 2022.

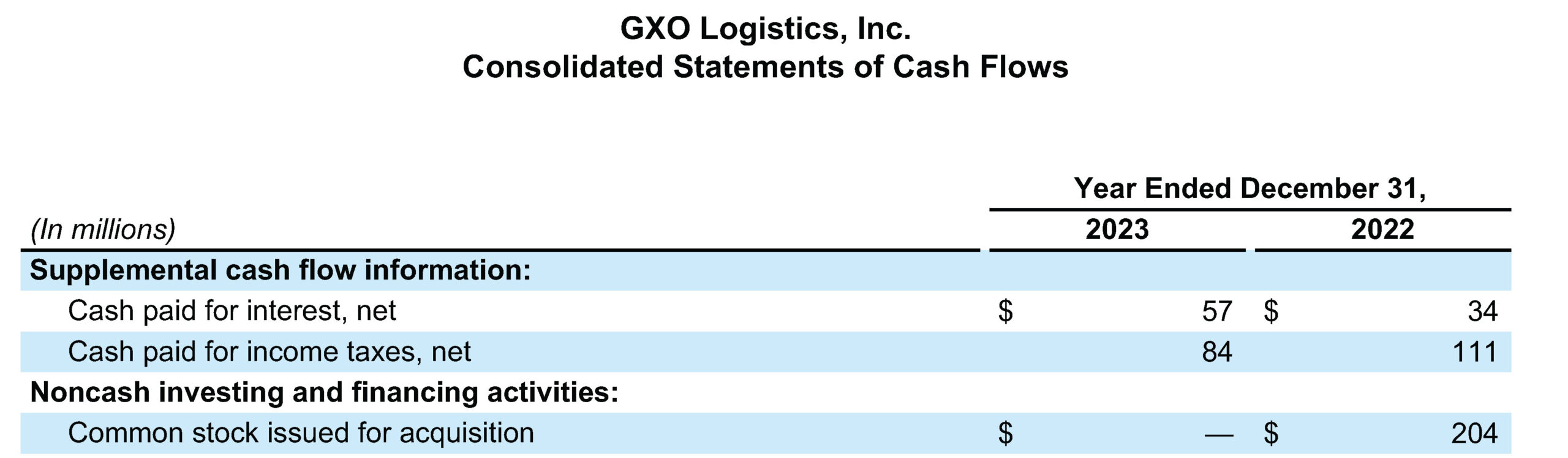

GXO generated $558 million of cash flows from operations, compared with $542 million for 2022. GXO generated $302 million of free cash flowi, compared with $240 million for 2022. Cash flows from operations to net income attributable to GXO and free cash flow conversioni ratios were 244% and 41%, respectively, for 2023. Cash flows from operations to net income attributable to GXO and free cash flow conversioni ratios were 275% and 33%, respectively, for 2022.

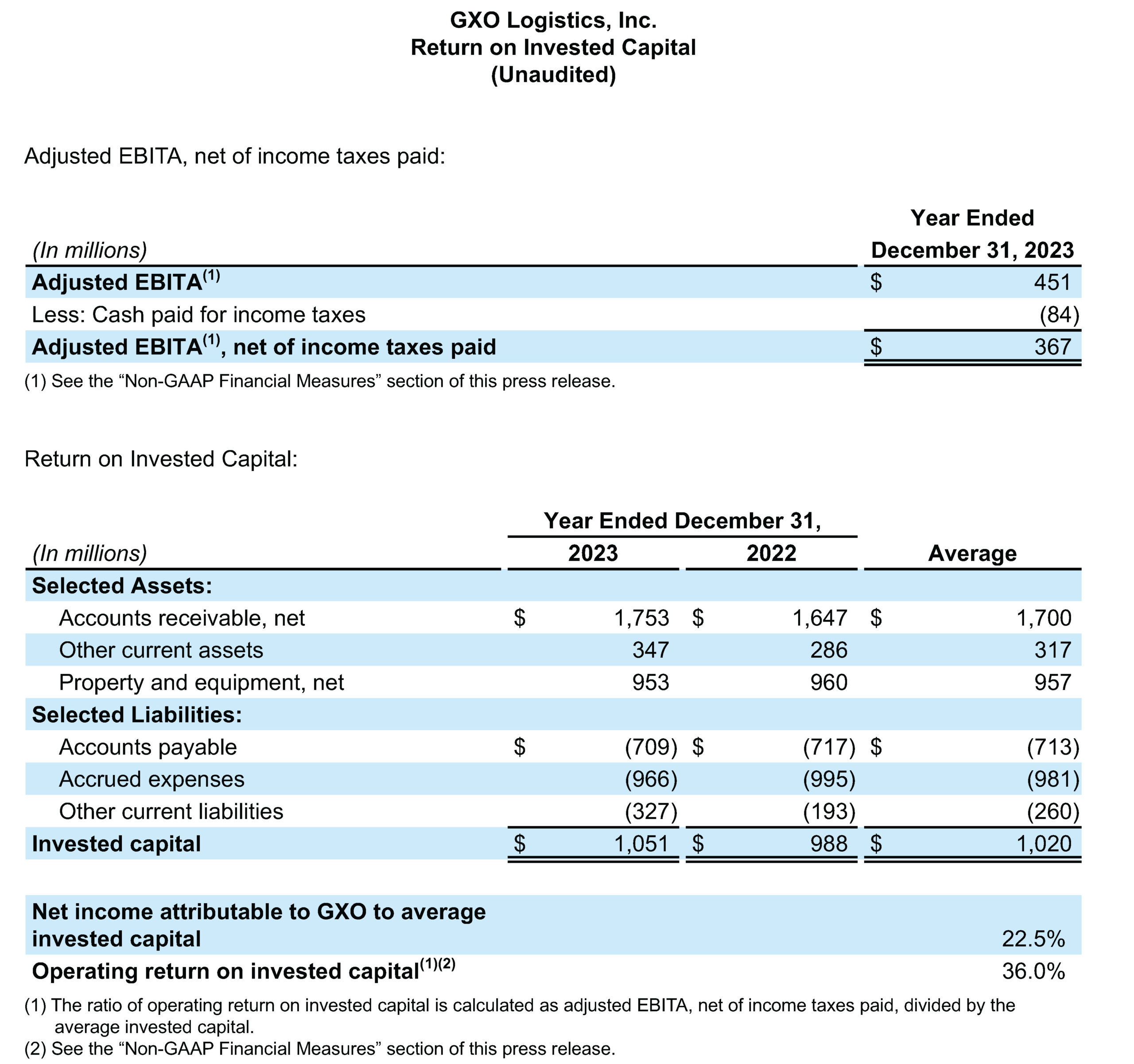

Net income attributable to GXO to average invested capital and operating return on invested capitali ratios were 22% and 36%, respectively, for 2023.

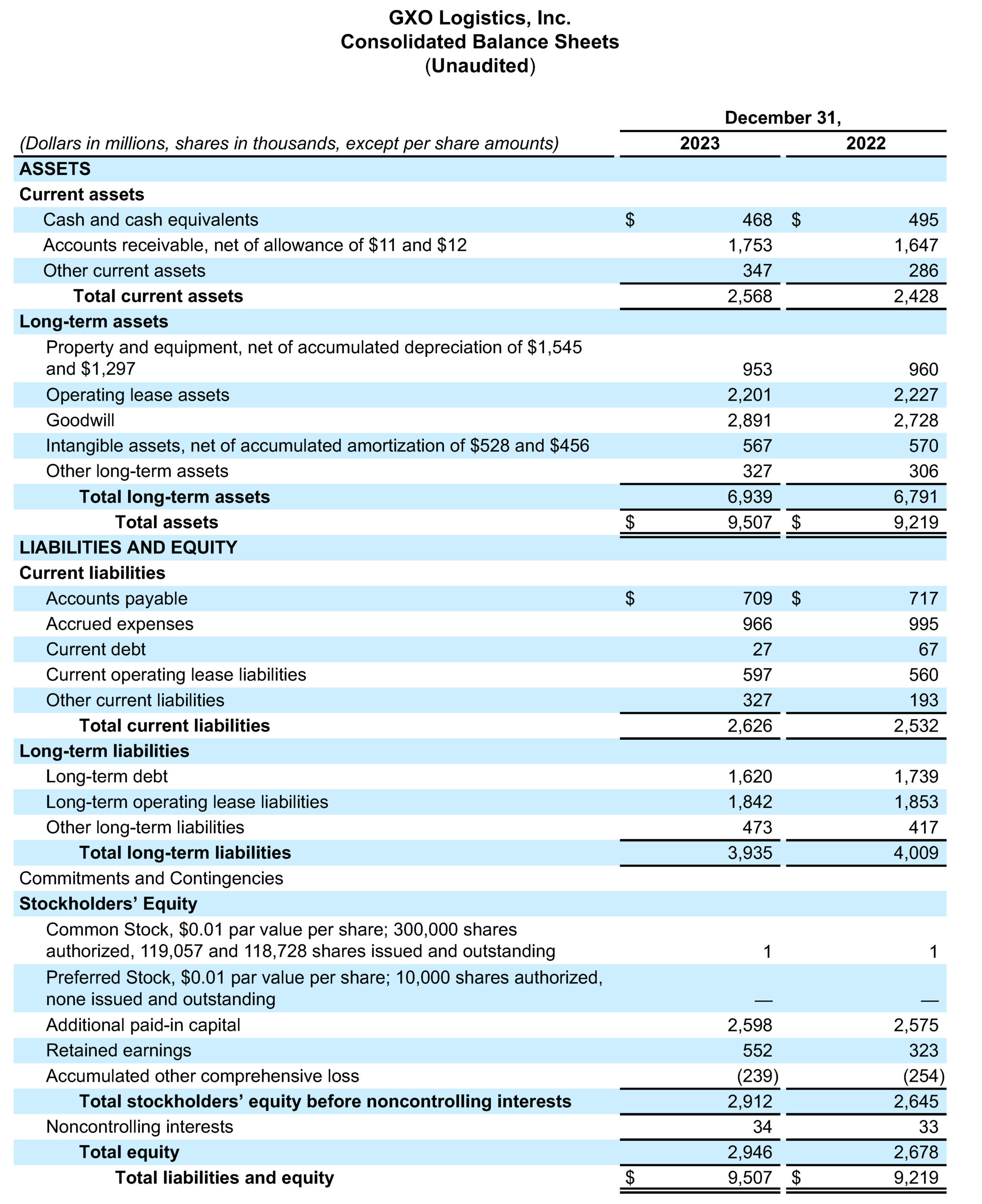

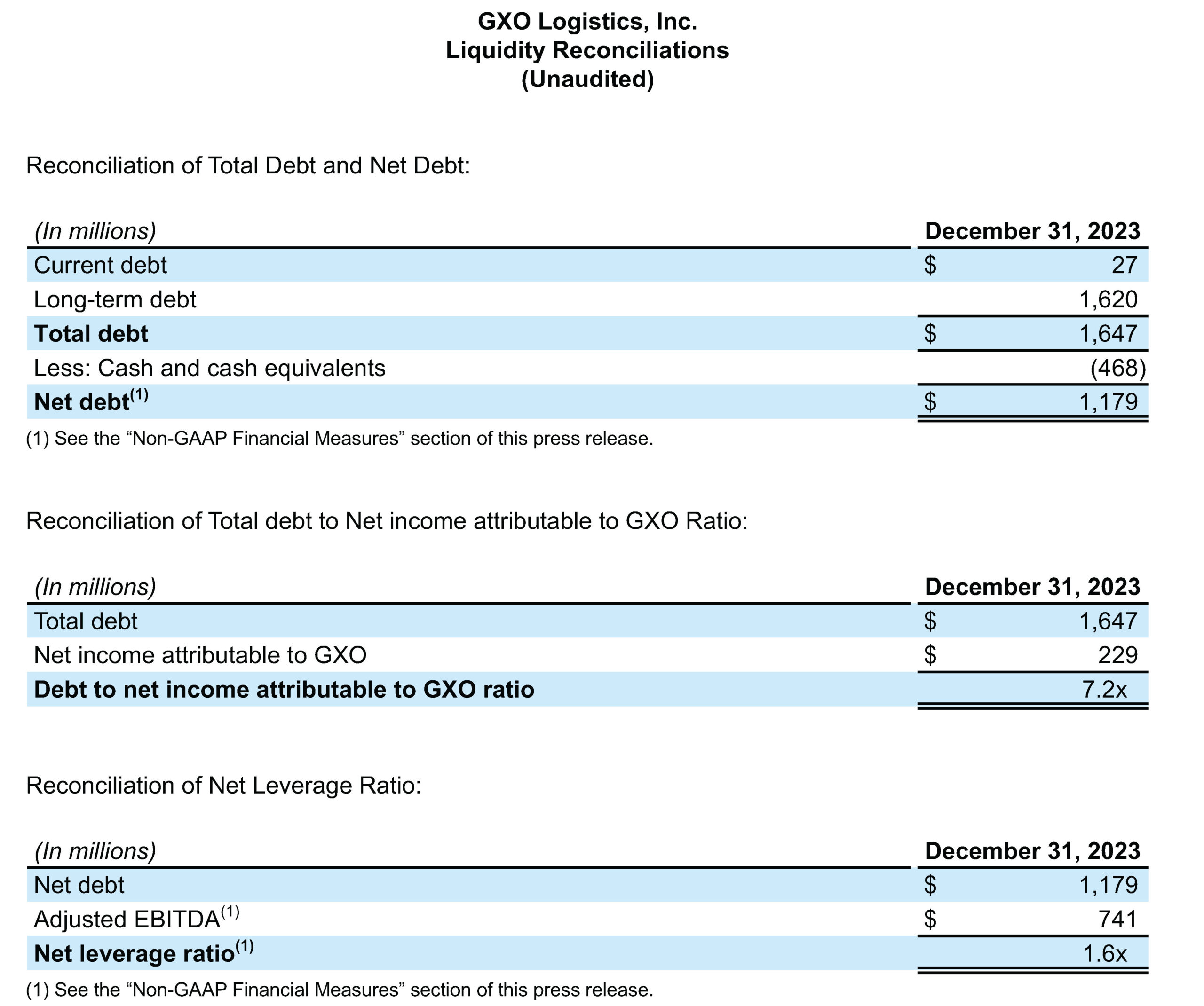

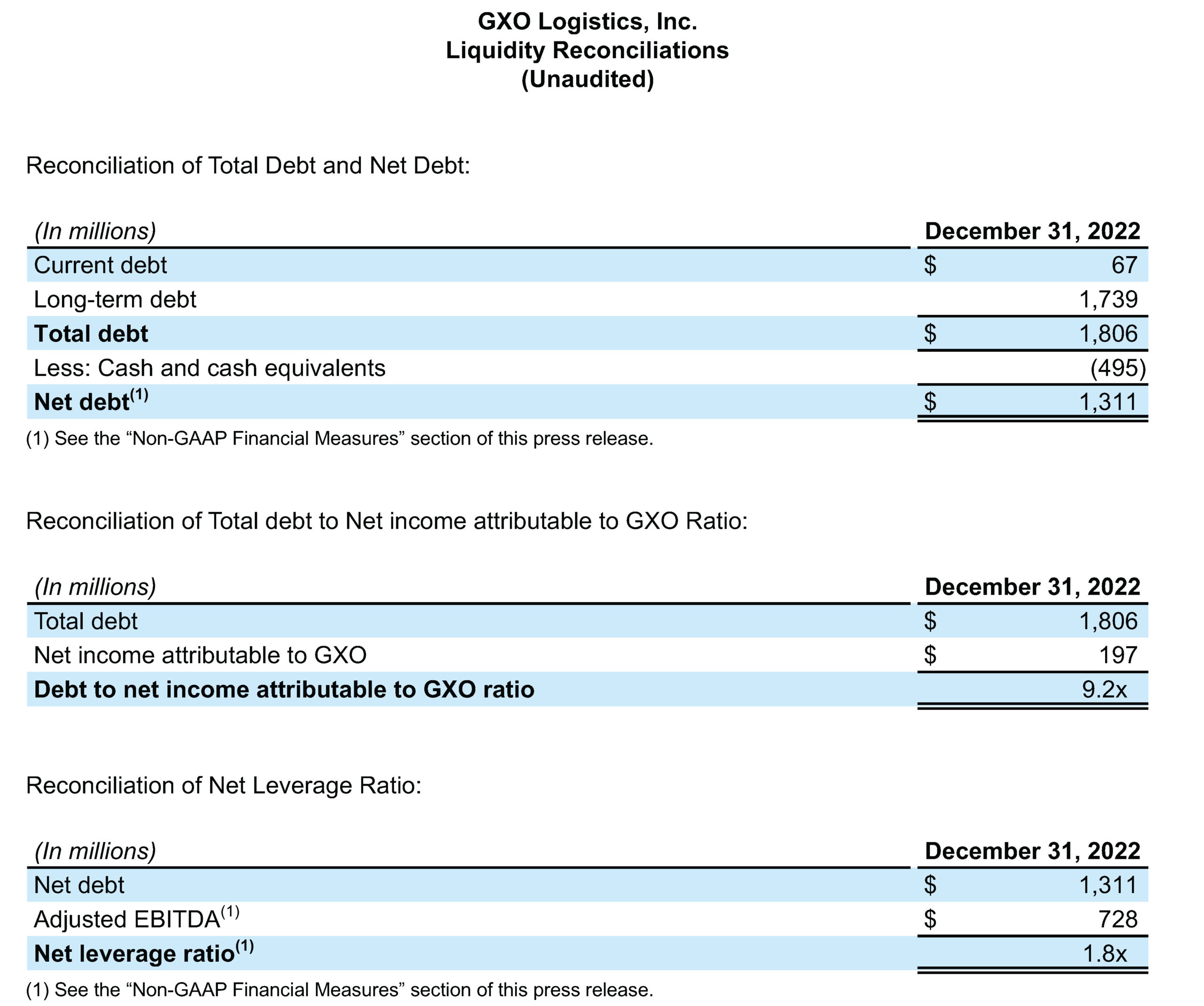

Cash Balances and Outstanding Debt

As of December 31, 2023, cash and cash equivalents and debt outstanding were $468 million and $1.6 billion, respectively. GXO’s balance sheet remains investment grade and received credit rating outlook upgrades from S&P, Moody’s and Fitch during 2023.

2024 Guidance2

GXO’s 2024 financial outlook is as follows:

- Organic revenue growthi of 2% to 5%;

- Adjusted EBITDAi of $760 million to $790 million;

- Adjusted diluted earnings per sharei of $2.70 to $2.90; and

- Free cash flow conversioni of 30% to 40% of adjusted EBITDAi.

- For definitions of non-GAAP measures see the “Non-GAAP Financial Measures” section in this press release.

- Our guidance reflects current FX rates.

Teleconferentie

GXO will hold a conference call on Wednesday, February 14, 2024, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 877-407-8029; international callers dial +1 201-689-8029. Conference ID: 13743710. A live webcast of the conference will be available on the Investor Relations area of the company’s website, investors.gxo.com. The conference will be archived until February 28, 2024. To access the replay by phone, call toll-free (from US/Canada) 877-660-6853; international callers dial +1 201-612-7415. Use participant passcode 13743710.

Over GXO Logistics

GXO Logistics, Inc. (NYSE: GXO) is 's werelds grootste leverancier van contractlogistiek die profiteert van de snelle groei van e-commerce, automatisering en outsourcing. GXO streeft ernaar een gevarieerde werkplek van wereldklasse te bieden aan meer dan 135.000 teamleden op meer dan 970 magazijnlocaties met een totale oppervlakte van ongeveer 200 miljoen vierkante meter. Het bedrijf werkt samen met 's werelds toonaangevende blue-chip bedrijven om complexe logistieke uitdagingen op te lossen met technologisch geavanceerde supply chain en e-commerce oplossingen, op schaal en met snelheid. Het hoofdkantoor van GXO is gevestigd in Greenwich, Conn., VS. BezoekGXO.comvoor meer informatie en neem contact op met GXO op LinkedIn, X (formerly Twitter), Facebook, Instagram en YouTube.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this release.

GXO’s non-GAAP financial measures in this press release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), adjusted EBITDA margin, adjusted earnings before interest, taxes and amortization (“adjusted EBITA”), adjusted EBITA, net of income taxes paid, adjusted EBITA margin, adjusted net income attributable to GXO, adjusted earnings per share (basic and diluted) (“adjusted EPS”), free cash flow, free cash flow conversion, organic revenue, organic revenue growth, net leverage ratio, net debt, and operating return on invested capital (“ROIC”).

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, GXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. GXO’s non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted EBITA, adjusted net income attributable to GXO and adjusted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the financial tables below. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and separating IT systems. Restructuring costs primarily relate to severance costs associated with business optimization initiatives.

We believe that free cash flow and free cash flow conversion are important measures of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as cash flows from operations less capital expenditures plus proceeds from sale of property and equipment. We calculate free cash flow conversion as free cash flow divided by adjusted EBITDA, expressed as a percentage.

We believe that adjusted EBITDA, adjusted EBITDA margin, adjusted EBITA, adjusted EBITA, net of income taxes paid, and adjusted EBITA margin, improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses.

We believe that adjusted net income attributable to GXO and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains, which management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets.

We believe that organic revenue and organic revenue growth are important measures because they exclude the impact of foreign currency exchange rate fluctuations, revenue from acquired businesses and revenue from deconsolidated operations.

We believe that net leverage ratio and net debt are important measures of our overall liquidity position and are calculated by removing cash and cash equivalents from our total debt and net debt as a ratio of our adjusted EBITDA. We calculate ROIC as our adjusted EBITA, net of income taxes paid divided by the average invested capital. We believe ROIC provides investors with an important perspective on how effectively GXO deploys capital and use this metric internally as a high-level target to assess overall performance throughout the business cycle.

Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating GXO’s ongoing performance.

With respect to our financial targets for full-year 2024 organic revenue growth, adjusted EBITDA, adjusted diluted EPS, and free cash flow conversion, a reconciliation of these non-GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non-GAAP target measures. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statements of income and cash flows prepared in accordance with GAAP, that would be required to produce such a reconciliation.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements, including our full year 2024 financial targets of organic revenue growth, adjusted EBITDA, adjusted diluted earnings per share and free cash flow conversion; the expected incremental revenue in 2024 and 2025 from new customer wins in 2023; the proliferation of AI and automation deployment across our operations to accelerate in 2024 and beyond; continued strong performance in 2024; and long-term growth trajectory. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by the company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors the company believes are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, the risks discussed in our filings with the SEC and the following: economic conditions generally; supply chain challenges, including labor shortages; our ability to align our investments in capital assets, including equipment, and warehouses, to our customers’ demands; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; unsuccessful acquisitions or other risks or developments that adversely affect our financial condition and results; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our indebtedness; our ability to raise debt and equity capital; litigation; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers’ facilities and efforts by labor organizations to organize our employees; risks associated with defined benefit plans for our current and former employees; our inability to attract or retain necessary talent; the increased costs associated with labor; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; seasonal fluctuations; issues related to our intellectual property rights; governmental regulation, including environmental laws, trade compliance laws, as well as changes in international trade policies and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; natural disasters, terrorist attacks or similar incidents; damage to our reputation; a material disruption of the company’s operations; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; failure in properly handling the inventory of our customers; the impact of potential cyber-attacks and information technology or data security breaches; the inability to implement technology initiatives successfully; our ability to achieve our Environmental, Social and Governance goals; and a determination by the IRS that the distribution or certain related spin-off transactions should be treated as taxable transactions.

All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

Media Contacten

Click here to download the press release in PDF format.