- First quarter revenue of $2.5 billion, up 6% year over year; organic revenue growth1 of 1%

- Signed new business wins of approximately $250 million in annualized revenue in 1Q 2024; up 55% year over year

- Sales pipeline at 12-month high of $2.2 billion

- Completed acquisition of Wincanton on April 29, 2024

GXO Logistics, Inc. (NYSE: GXO) today announced results for the first quarter 2024.

Malcolm Wilson, chief executive officer of GXO, said, “We delivered a strong start to 2024, reflecting our solid execution amid improving industry dynamics. The company grew revenue by 6% to $2.5 billion and delivered positive organic revenue growth, while gaining market share. We look forward to driving continued growth throughout 2024 and are on track to achieve our full-year outlook.

“We’re seeing strengthening demand from global blue-chip customers to realize operational efficiencies today while planning fulfillment strategies to meet their future needs. We signed approximately $250 million dollars of new business during the quarter, and total new business wins were up 55% year over year. More than half of these new wins came from customers outsourcing to us or partnering with us for the first time.

“In the first quarter, we also announced our strategic acquisition of Wincanton, which we closed last week. Wincanton gives us a platform for growth in attractive verticals, including industrial and aerospace in Europe, and we expect to deliver double-digit accretion to adjusted EPS post-synergies.

“Looking forward, our new business wins and our sales pipeline give us confidence that our growth trajectory is accelerating. We’re investing in our sales organization, expanding automation and AI across our footprint, and diversifying into new geographies and verticals to best position ourselves to deliver shareholder value through profitable growth.”

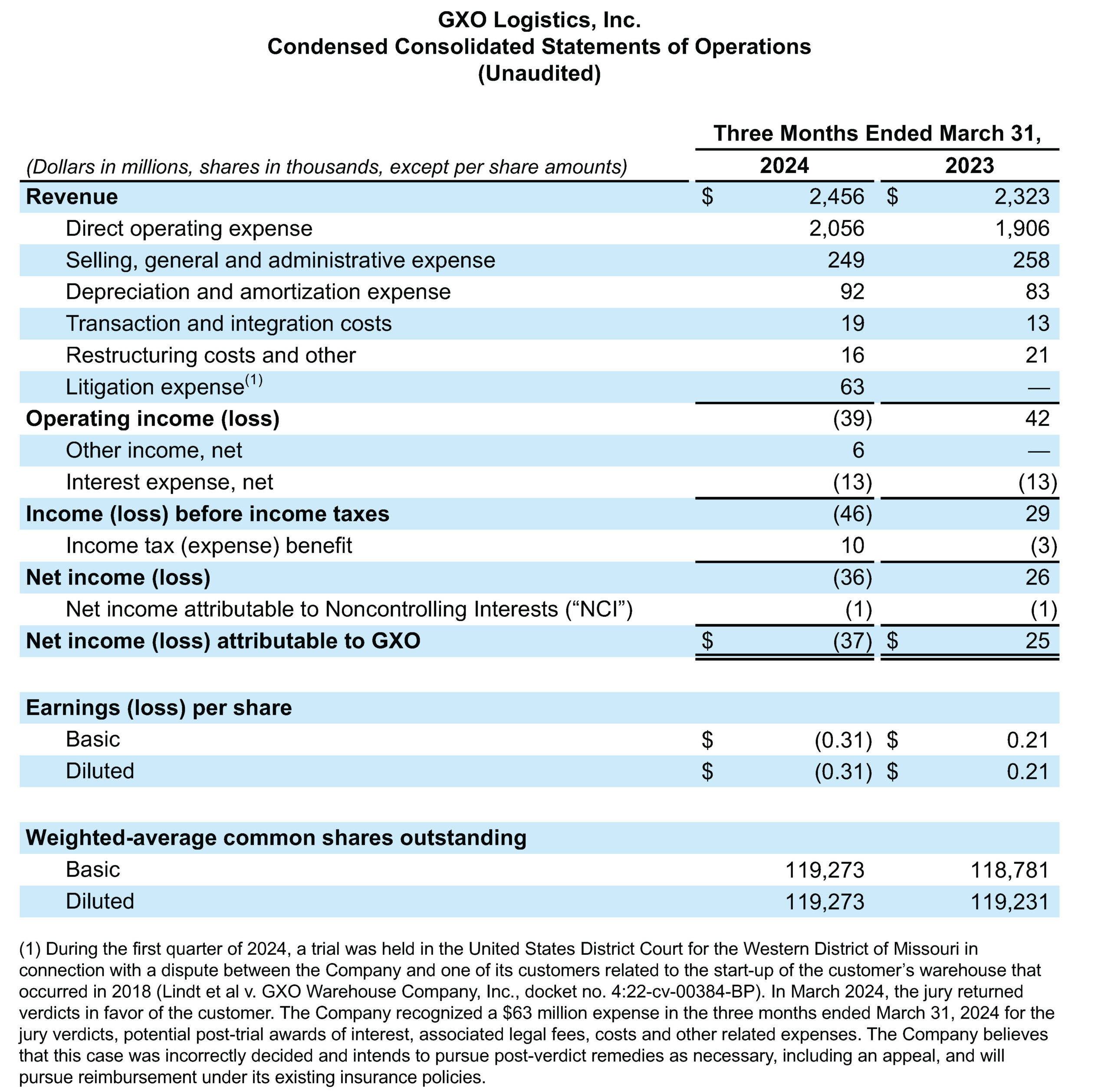

First Quarter 2024 Results

Revenue increased to $2.5 billion, compared with $2.3 billion for the first quarter 2023. Net loss was $36 million, primarily driven by a $63 million expense associated with legacy litigation, compared with $26 million net income for the first quarter 2023. Diluted loss per share was $0.31, compared with $0.21 diluted earnings per share for the first quarter 2023.

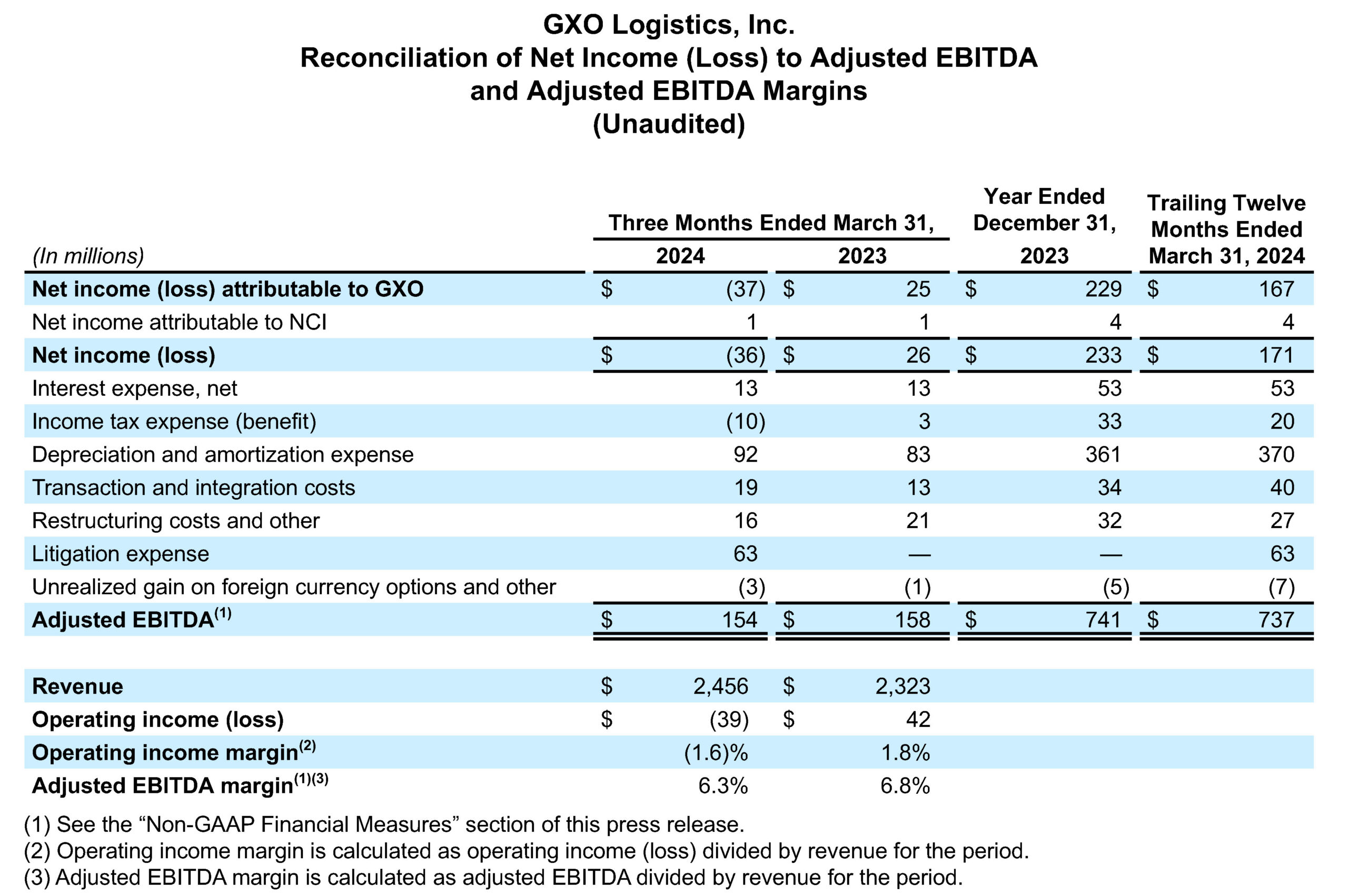

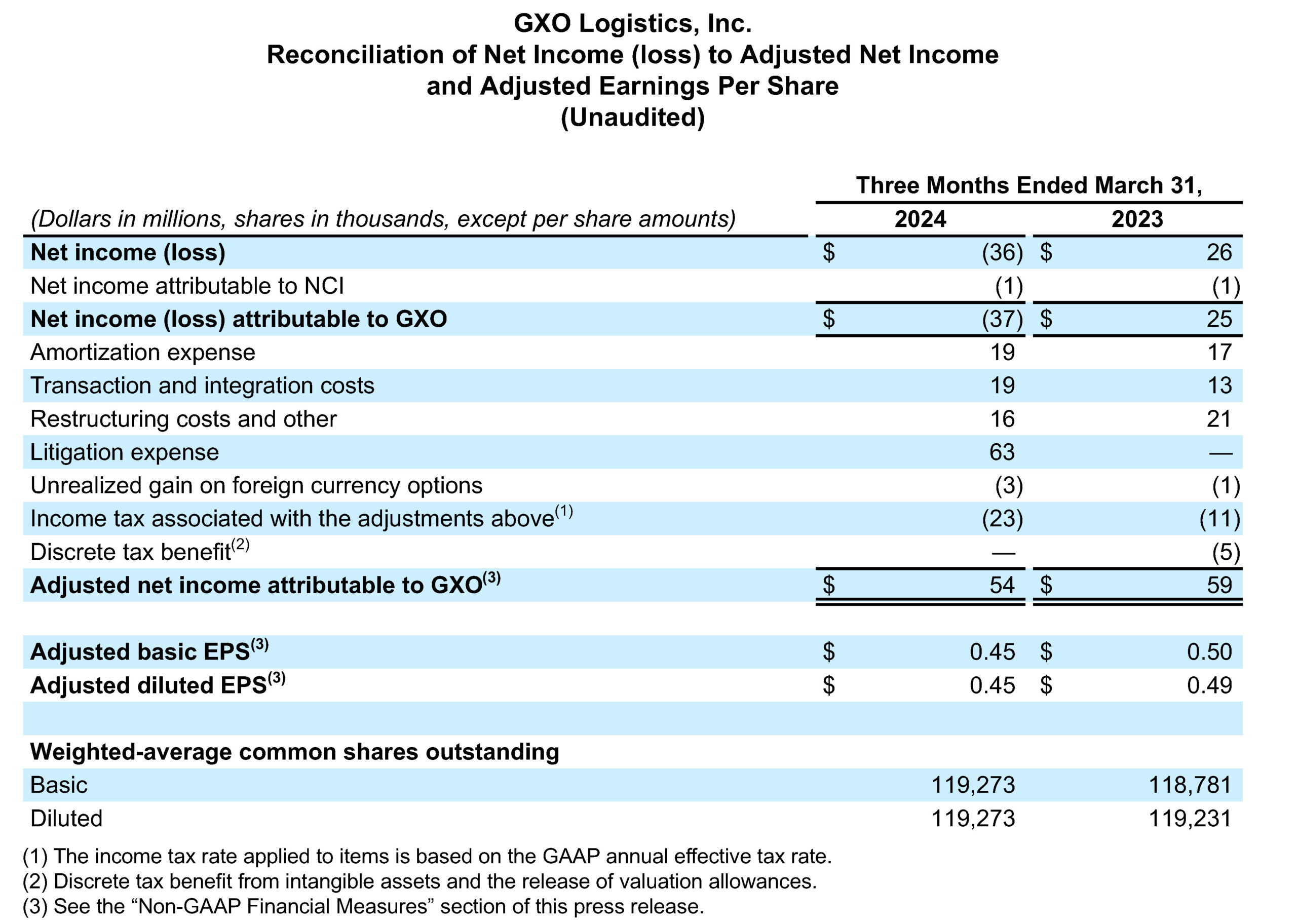

Adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA1”) was $154 million, compared with $158 million for the first quarter 2023. Adjusted diluted EPS1 was $0.45, compared with $0.49 for the first quarter 2023.

GXO generated $50 million of cash flow from operations, compared with $39 million for the first quarter 2023. In the first quarter of 2024, GXO used $17 million of free cash flow1, compared with $43 million used for the first quarter 2023.

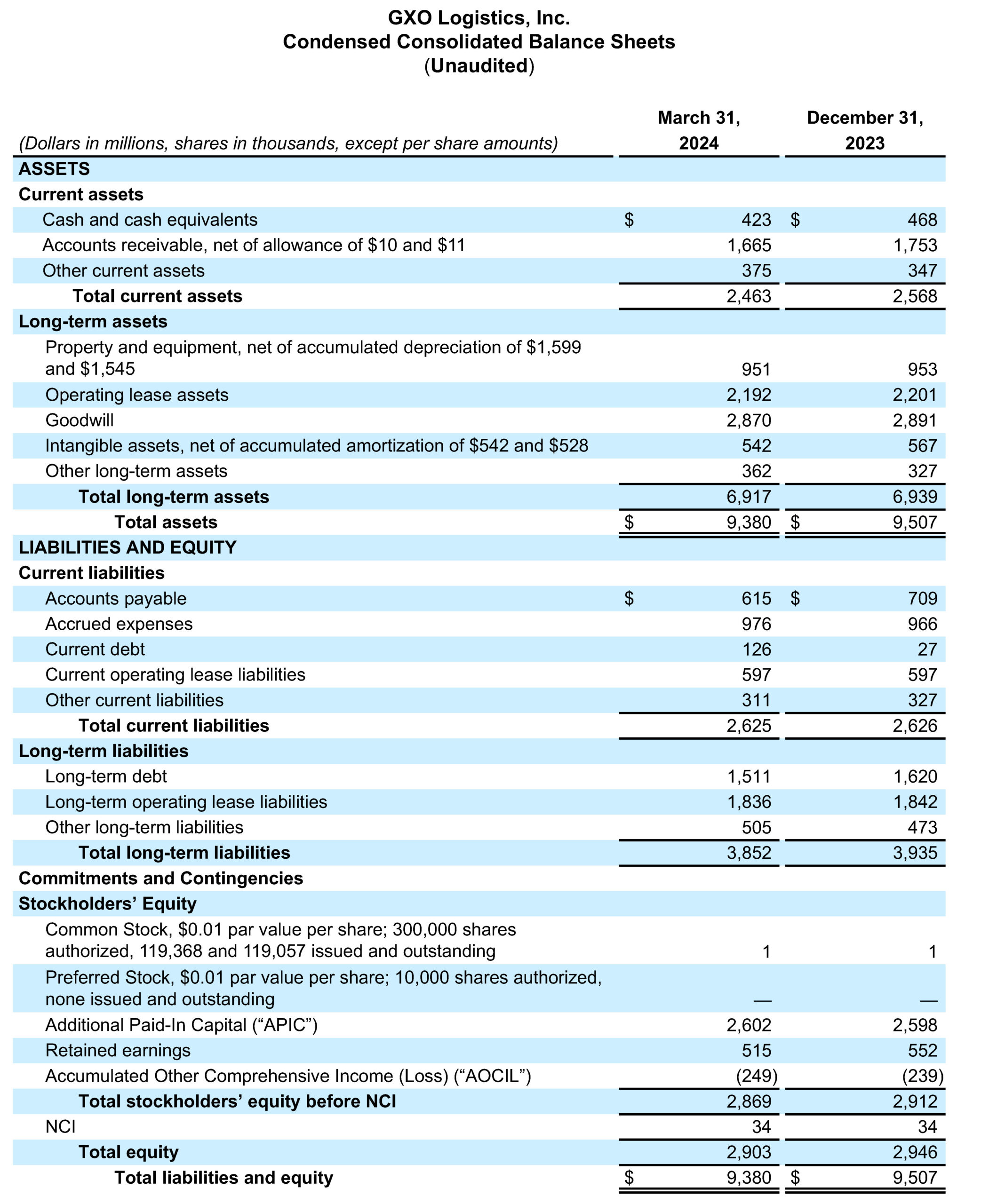

Cash Balances and Outstanding Debt

As of March 31, 2024, cash and cash equivalents and debt outstanding were $423 million and $1.6 billion, respectively, as part of GXO’s investment grade balance sheet.

Updated guidance

As previously announced on April 24, 2024, the company reiterated its guidance for the full year 2024 and its 2027 financial targets as follows:

- 2024 Guidance2

- Standalone basis (unchanged):

- Organic revenue growth1 of 2% to 5%;

- Adjusted EBITDA1 of $760 million to $790 million;

- Adjusted diluted EPS1 of $2.70 to $2.90; and

- Free cash flow conversion1 of 30% to 40% of adjusted EBITDA1.

- Including expected impact of Wincanton acquisition:

- Organic revenue growth1 of 2% to 5%;

- Adjusted EBITDA1 of $805 million to $835 million;

- Adjusted diluted EPS1 of $2.73 to $2.93; and

- Free cash flow conversion1 of 30% to 40% of adjusted EBITDA1.

- Standalone basis (unchanged):

- 2027 Financial Targets2

- Organic revenue CAGR (2024-2027)1,3 of approximately 10%, to approximately $15.5 billion to $16.0 billion of revenue;

- Approximately 15% adjusted EBITDA CAGR (2024-2027)1,3, to approximately $1.25 billion to $1.30 billion of adjusted EBITDA1;

- Adjusted diluted EPS CAGR (2024-2027)1,3 of more than 15%;

- Free cash flow conversion1 of greater than 30% of adjusted EBITDA (2024-2027)1; and

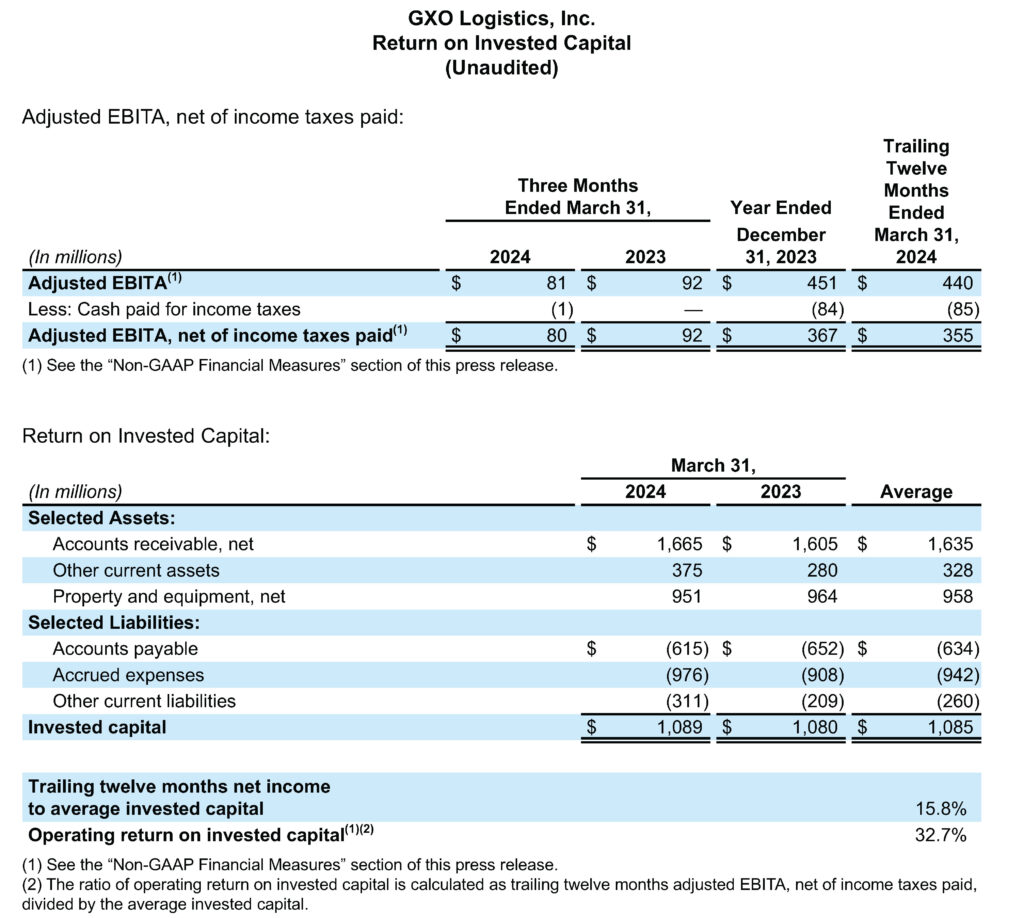

- Operating return on invested capital1 of more than 30%.

- For definitions of non-GAAP measures see the “Non-GAAP Financial Measures” section in this press release.

- Our guidance reflects current FX rates.

- Compound Annual Growth Rate (CAGR).

Conférence téléphonique

GXO will hold a conference call on Wednesday, May 8, 2024, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 877-407-8029; international callers dial +1 201-689-8029. Conference ID: 13745710. A live webcast of the conference will be available on the Investor Relations area of the company’s website, investors.gxo.com. The conference will be archived until May 22, 2024. To access the replay by phone, call toll-free (from US/Canada) 877-660-6853; international callers dial +1 201-612-7415. Use participant passcode 13745710.

A propos de GXO Logistics

GXO logistics, Inc. (NYSE : GXO) est le plus grand prestataire pure-player de logistique contractuelle au monde et bénéficie de la croissance rapide du e-commerce, de l'automatisation et de l'externalisation. GXO s'engage à fournir un environnement de travail diversifié de niveau international à ses 130 000 collaborateurs répartis sur 970 sites totalisant une surface d’environ 18,5 millions de mètres carrés d’entreposage. L'entreprise collabore avec des clients d’envergure internationale pour relever des défis logistiques complexes grâce à des solutions technologiquement avancées et des solutions pour le e-commerce à grande échelle et d’implémentation rapide. Le siège social de GXO est situé à Greenwich, dans le Connecticut, aux États-Unis. Rendez-vous sur GXO.com pour plus d’informations, et suivez GXO sur LinkedIn, X, Facebook, Instagram et YouTube.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this release.

GXO’s non-GAAP financial measures in this press release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), adjusted EBITDA margin, adjusted EBITDA CAGR, adjusted earnings before interest, taxes and amortization (“adjusted EBITA”), adjusted EBITA, net of income taxes paid, adjusted EBITA margin, adjusted net income attributable to GXO, adjusted earnings per share (basic and diluted) (“adjusted EPS”), adjusted diluted EPS CAGR, free cash flow, free cash flow conversion, organic revenue, organic revenue growth, organic revenue CAGR, net leverage ratio, net debt, and operating return on invested capital (“ROIC”).

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, GXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. GXO’s non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted EBITA, adjusted net income attributable to GXO and adjusted EPS include adjustments for transaction and integration costs, litigation expenses as well as restructuring costs and other adjustments as set forth in the financial table below. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities), and certain costs related to integrating and separating IT systems. Litigation expenses primarily relate to the settlement of ongoing legal matters. Restructuring costs primarily relate to severance costs associated with business optimization initiatives.

We believe that adjusted EBITDA, adjusted EBITDA margin, adjusted EBITA, adjusted EBITA, net of income taxes paid, and adjusted EBITA margin, improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses.

We believe that organic revenue and organic revenue growth are important measures because they exclude the impact of foreign currency exchange rate fluctuations, revenue from acquired businesses and revenue from disposed business.

We believe that adjusted net income attributable to GXO and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains, which management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets.

We believe that free cash flow and free cash flow conversion are important measures of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as cash flows from operations less capital expenditures plus proceeds from sale of property and equipment. We calculate free cash flow conversion as free cash flow divided by adjusted EBITDA, expressed as a percentage.

We believe that net debt and net leverage ratio are important measures of our overall liquidity position and are calculated by adding bank overdrafts and removing cash and cash equivalents from our total debt and net debt as a ratio of our adjusted EBITDA. We calculate ROIC as our adjusted EBITA, net of income taxes paid divided by the average invested capital. We believe ROIC provides investors with an important perspective on how effectively GXO deploys capital and use this metric internally as a high-level target to assess overall performance throughout the business cycle.

Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating GXO’s ongoing performance.

With respect to our financial targets for full-year 2024 organic revenue growth, adjusted EBITDA, adjusted diluted EPS, and free cash flow conversion and our 2027 financial targets of organic revenue CAGR, adjusted EBITDA, adjusted EBITDA CAGR, adjusted diluted EPS CAGR, free cash flow conversion and ROIC, a reconciliation of these non-GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non-GAAP target measures. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statements of income and cash flows prepared in accordance with GAAP, that would be required to produce such a reconciliation.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements, including our full-year 2024 guidance, our 2027 guidance, and the expected impact of the acquisition of Wincanton on our results of operations. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by the company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors the company believes are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, the risks discussed in our filings with the SEC and the following: economic conditions generally; supply chain challenges, including labor shortages; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our respective customers’ demands; our ability to successfully integrate and realize anticipated benefits, synergies, cost savings and profit improvement opportunities with respect to acquired companies, including the acquisition of Wincanton; acquisitions may be unsuccessful or result in other risks or developments that adversely affect our financial condition and results; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our indebtedness; our ability to raise debt and equity capital; litigation; labor matters, including our ability to manage its subcontractors, and risks associated with labor disputes at our customers’ facilities and efforts by labor organizations to organize its employees; risks associated with defined benefit plans for our current and former employees; our ability to attract or retain necessary talent; the increased costs associated with labor; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; fluctuations in customer confidence and spending; issues related to our intellectual property rights; governmental regulation, including environmental laws, trade compliance laws, as well as changes in international trade policies and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; natural disasters, terrorist attacks or similar incidents; damage to our reputation; a material disruption of our operations; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; failure in properly handling the inventory of our customers; the impact of potential cyber-attacks and information technology or data security breaches; and the inability to implement technology initiatives or business systems successfully; our ability to achieve Environmental, Social and Governance goals; and a determination by the IRS that the distribution or certain related spin-off transactions should be treated as taxable transactions. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Such forward-looking statements should therefore be construed in the light of such factors.

All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

Contacts

Click here to download this press release in PDF format.