Elemente importante

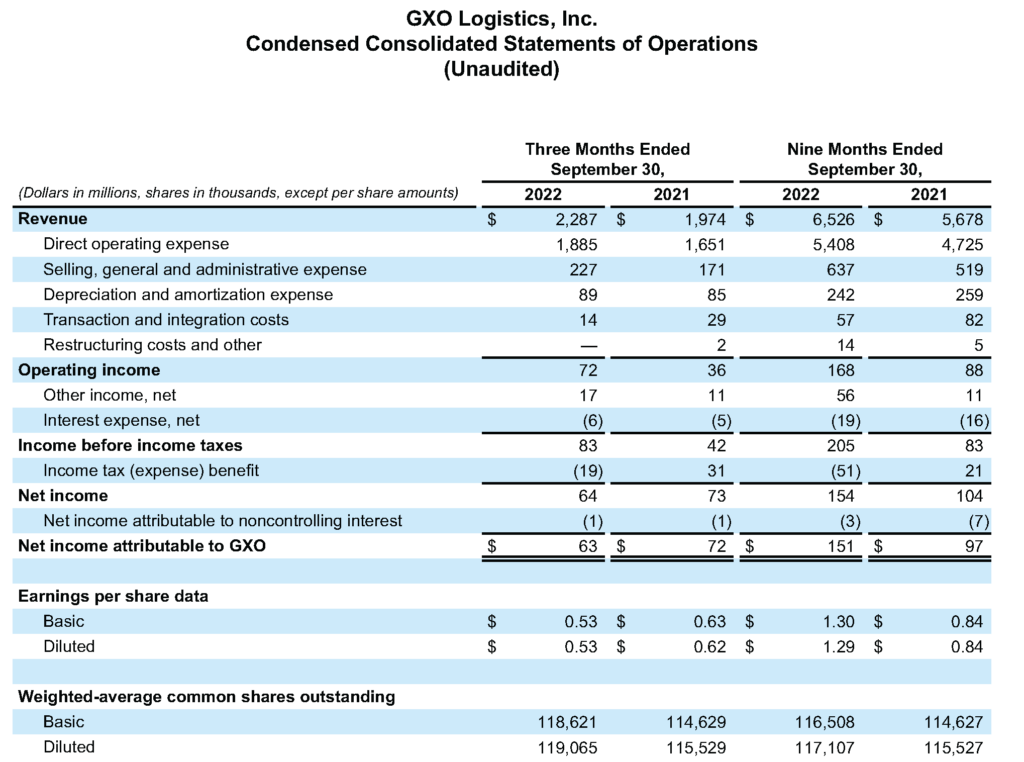

- Third quarter revenue of $2.3 billion, up 16% year-over-year; including organic revenue growth1 of 16%; net income attributable to GXO of $63 million; adjusted EBITDA1 of $192 million; diluted EPS of $0.53 and adjusted diluted EPS1 of $0.75

- 2022 FY guidance reiterated, including 12-16% organic revenue growth and adjusted EBITDA of $715-$750 million

Business Highlights

- Year to date wins of $977 million, with a robust sales pipeline of approximately $2.0 billion. $497 million in incremental revenue for 2023 secured by the end of 3Q 20222

- Revenue retention rate consistently in the mid-to-high 90s since spin

- Regulatory approval received for the acquisition of Clipper Logistics; integration has commenced

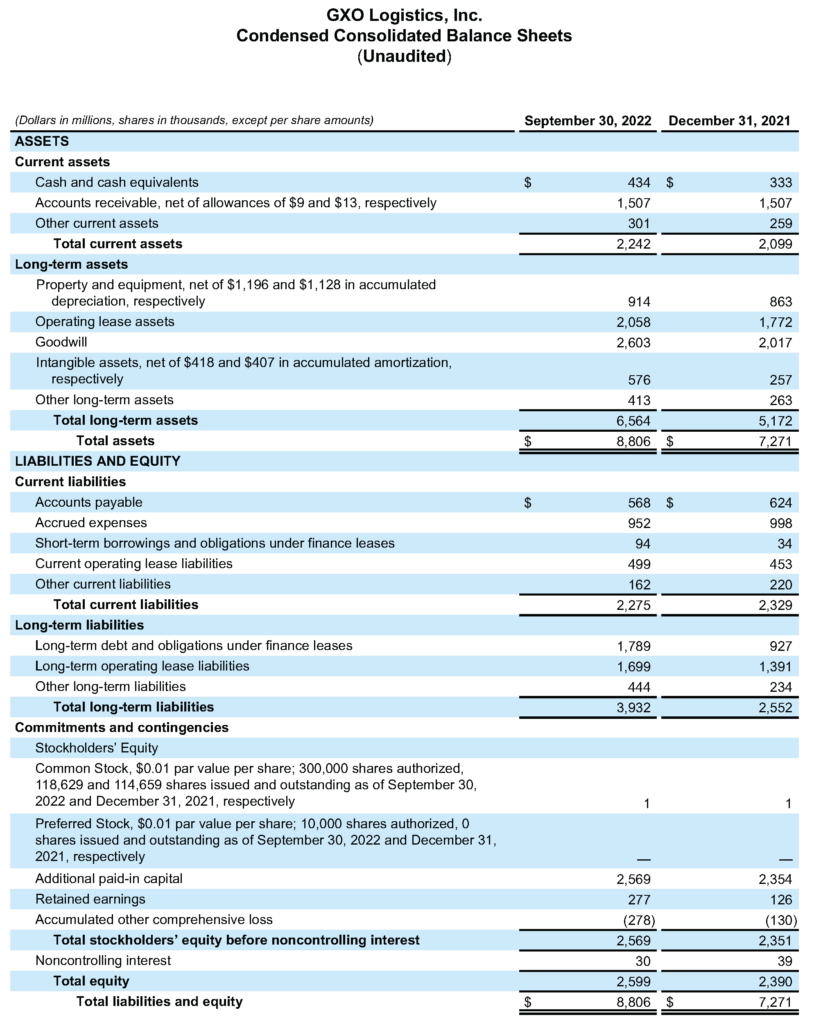

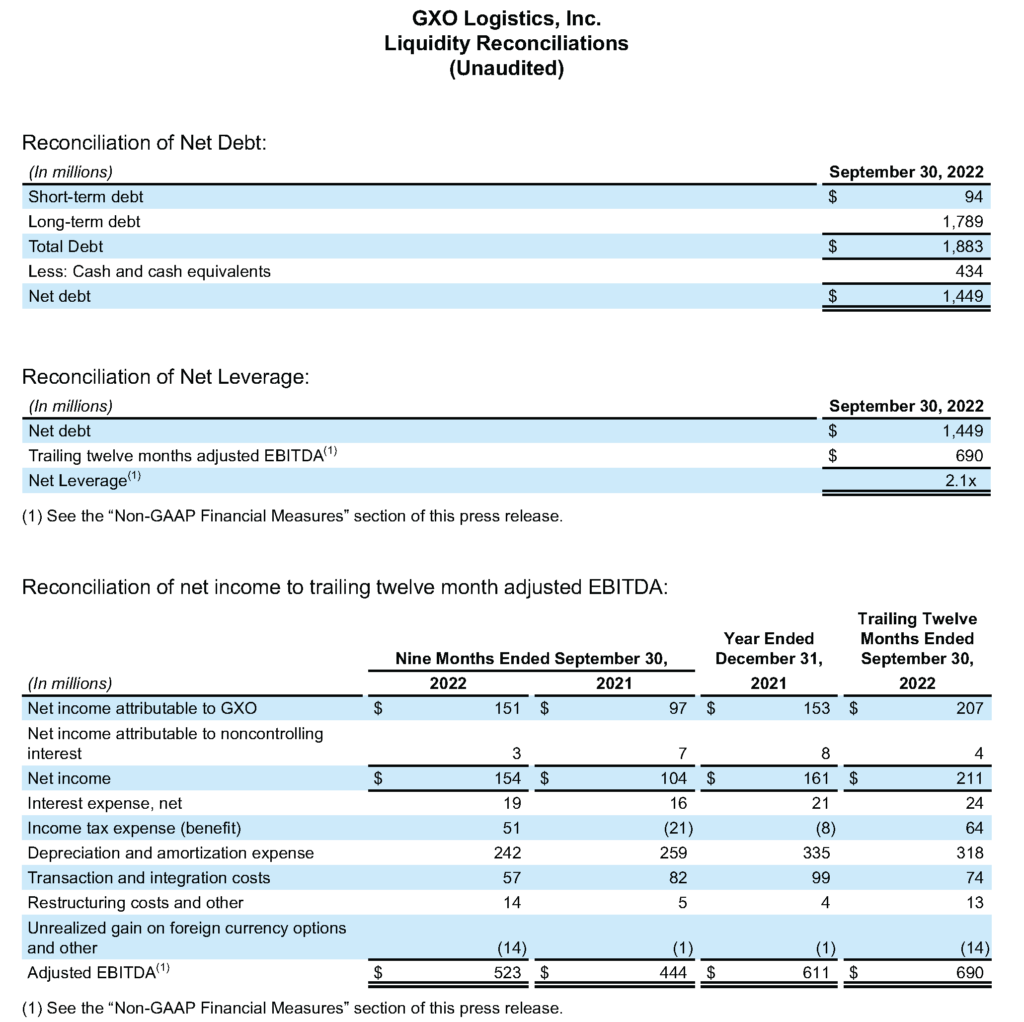

- Reduced net leverage1 to 2.1x with investment grade balance sheet

- Investor Days confirmed for January 12, 2023 in New York and January 17, 2023 in London

GXO Logistics, Inc. (NYSE: GXO) today announced results for the third quarter ended September 30, 2022.

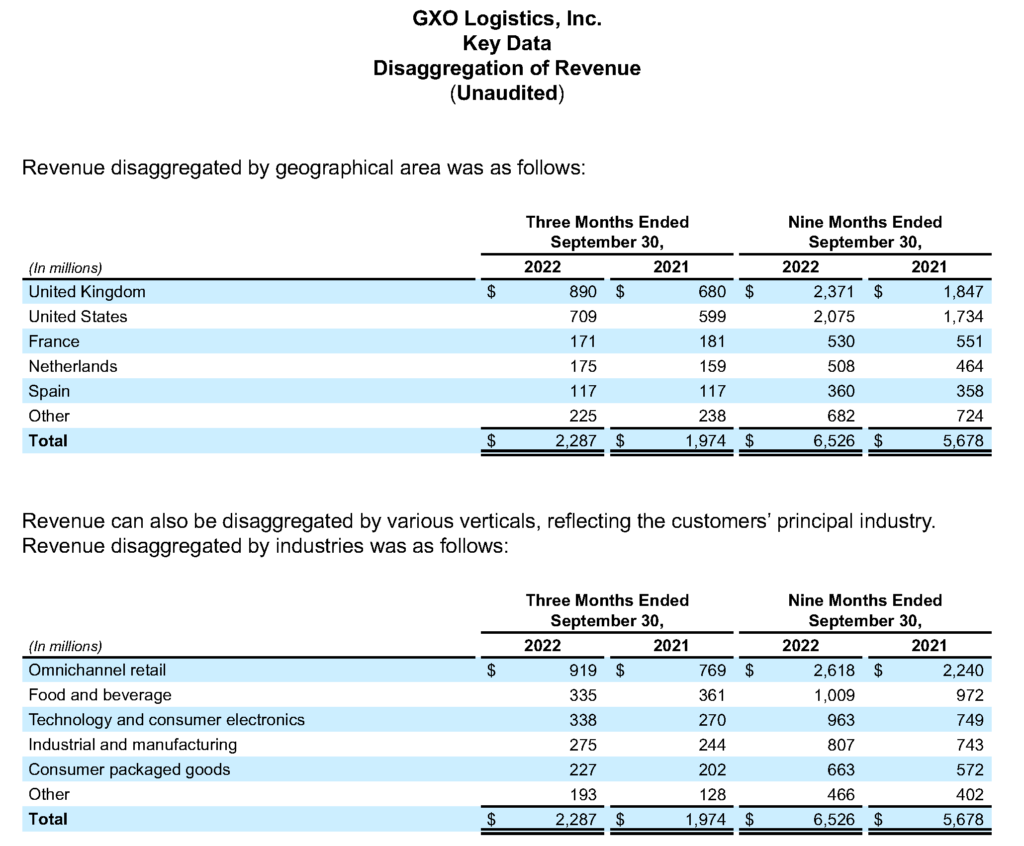

Malcolm Wilson, Chief Executive Officer of GXO, said, “In the third quarter, we once again posted strong operating and financial results and were pleased to deliver our highest-ever quarterly revenue, together with net income3 of $63 million and 19% year-over-year growth in our adjusted EBITDA. We continued to gain market share across verticals and geographies, with particular strength in consumer packaged goods, technology, and industrials, as demand continues to grow from both existing and new customers looking to improve productivity and reduce costs. With receipt of final regulatory approval from the U.K.’s Competition and Markets Authority for our acquisition of Clipper Logistics, integration is underway, and we anticipate realizing the lion’s share of the planned cost synergies in 2023 and 2024.

“We look forward to closing out the year on a high note, with expected topline and margin growth, and are reaffirming our full-year guidance. With the holiday season upon us, we are seeing a smoother peak, as inventory and labor are more readily available, and are laser focused on ensuring a successful holiday season for our customers.

“Looking beyond peak, we are confident for 2023 and expect to deliver notable growth. Our global pipeline is strong, our conversion rates remain high, and demand for the types of technology we provide is only accelerating. Based on our wins to date, we’ve already secured nearly half of a billion dollars of incremental revenue for next year, further strengthening our visibility for 2023. Amidst a dynamic macroeconomic environment, there are significant benefits to being a pure-play contract logistics provider, with long-term, contractual relationships that include inflation pass-throughs and minimum volume guarantees. We are excited to present our long-term vision to drive superior returns for our shareholders at our Investor Day.”

Third Quarter 2022 Results

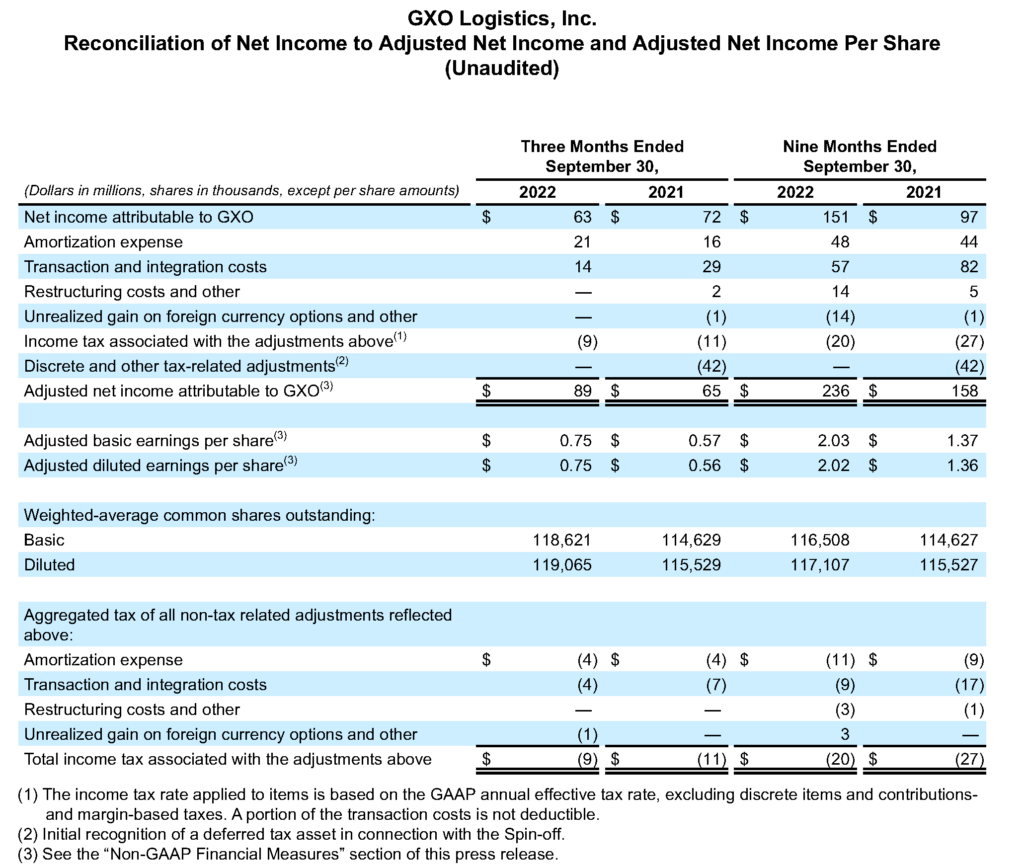

Revenue increased to $2.3 billion, compared with $2.0 billion for the third quarter 2021. Net income attributable to GXO was $63 million, compared with $72 million for the third quarter 2021. Third quarter 2021 net income reflected a $42 million one-time tax benefit related to the spin. Diluted earnings per share was $0.53, compared with $0.62 for the third quarter 2021.

Adjusted net income attributable to GXO1 was $89 million, compared with $65 million for the third quarter 2021. Adjusted diluted earnings per share1 was $0.75, compared with $0.56 for the third quarter 2021.

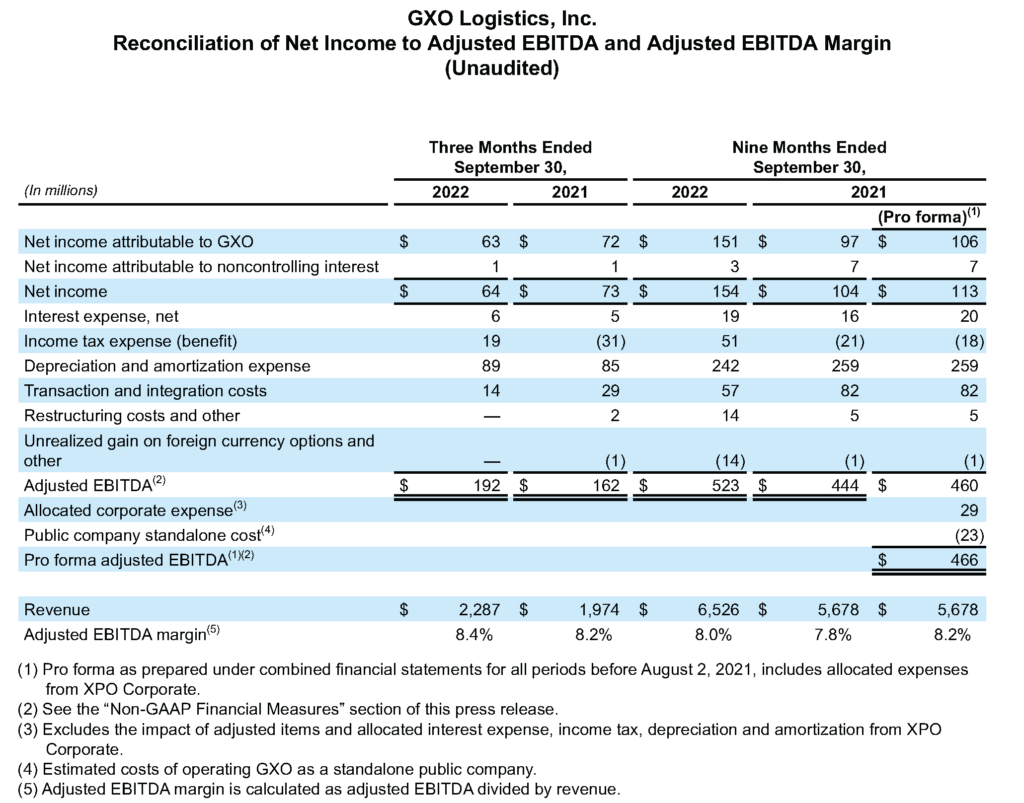

Adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA1”) increased to $192 million from $162 million in the third quarter 2021.

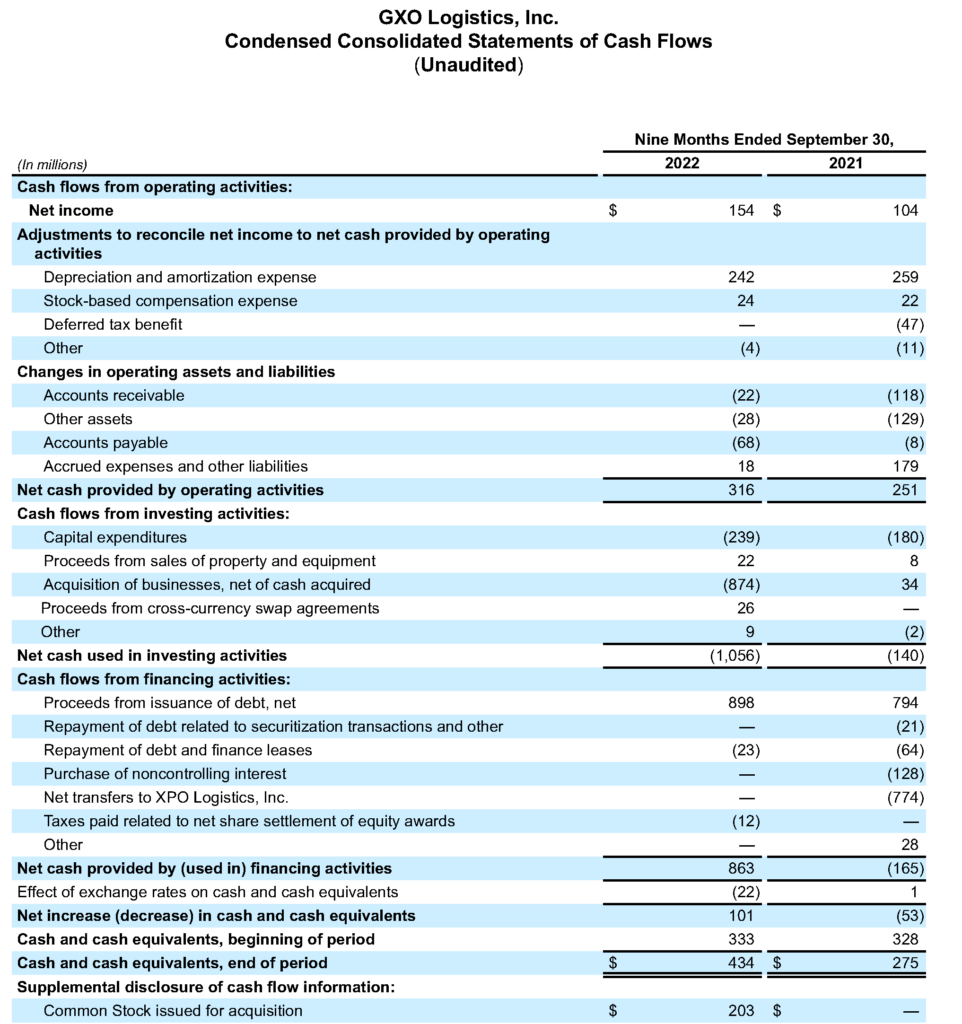

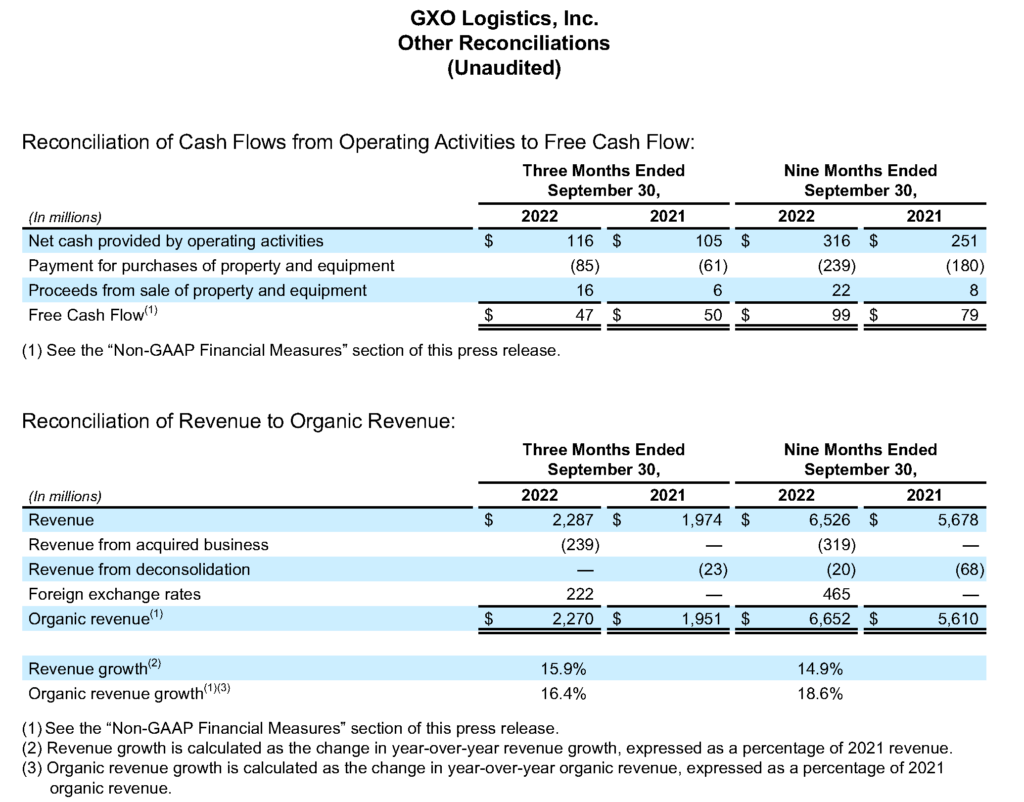

GXO generated $116 million of cash flow from operations, compared with $105 million for the third quarter 2021. In the third quarter 2022, GXO generated $47 million of free cash flow1, compared to $50 million for the third quarter 2021.

During the third quarter 2022, GXO won new customer contracts expected to contribute $158 million in annualized revenue. The new customer contracts GXO won through the third quarter 2022 are expected to contribute $497 million in incremental revenue in 2023.

2022 Guidance4

GXO is reiterating its full-year 2022 guidance, as follows:

- Organic revenue growth1 of 12%-16%

- Adjusted diluted earnings per share1 of $2.70-$2.90

- Adjusted EBITDA1 of $715 million to $750 million

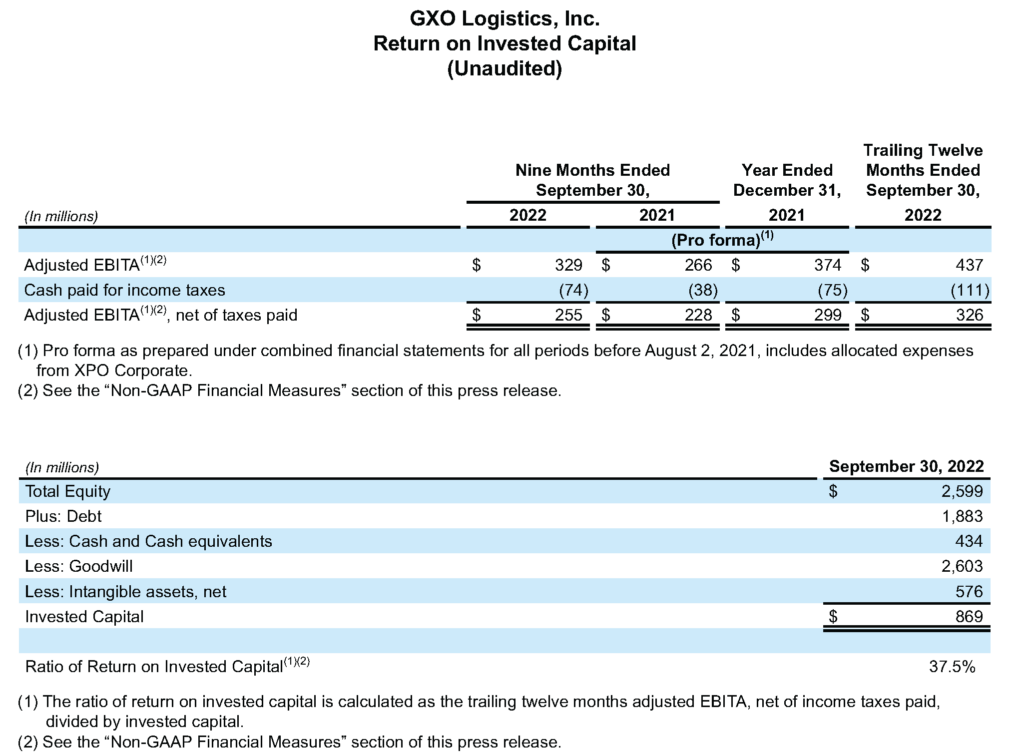

- Return on invested capital1 of greater than 30%

- Free cash flow1 of approximately 30% of adjusted EBITDA1

- For definitions of non-GAAP measures see the “Non-GAAP Financial Measures” section in this press release.

- 2023 incremental revenue and sales pipeline based on closing 3Q 2022 FX rates of 1.12 GBPUSD and 0.98 EURUSD. 2023 incremental revenue excludes the impact to expected GXO revenue from the Clipper acquisition.

- Net income attributable to GXO.

- Our guidance reflects the acquisition of Clipper Logistics, current foreign currency exchange rates, and the deconsolidation of a 50% owned joint venture.

Conference Call

GXO will hold a conference call on Wednesday, November 9, 2022, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 877-407-8029; international callers dial +1 201-689-8029. Conference ID: 13733392. A live webcast of the conference will be available on the Investor Relations area of the company’s website, investors.gxo.com. The conference will be archived until November 23, 2022. To access the replay by phone, call toll-free (from US/Canada) 877-660-6853; international callers dial +1 201-612-7415. Use participant passcode 13733392.

Despre GXO Logistics

GXO Logistics, Inc. (NYSE: GXO) este cel mai mare furnizor de servicii de logistică contractuală pure-play din lume și beneficiază de creșterea rapidă a comerțului electronic, a automatizării și a externalizării. GXO se angajează să ofere un loc de muncă divers, de clasă mondială, pentru mai mult de 130.000 de membri ai echipei în peste 950 de unități care însumează aproximativ 200 de milioane de metri pătrați. Compania colaborează cu cele mai importante companii de top din lume pentru a rezolva provocările logistice complexe cu soluții avansate din punct de vedere tehnologic pentru lanțul de aprovizionare și comerț electronic, la scară largă și cu rapiditate. Sediul corporativ al GXO se află în Greenwich, Connecticut, SUA. Vizitați GXO.com pentru mai multe informații și conectați-vă cu GXO pe LinkedIn, Twitter, Facebook, Instagram și YouTube.

Non-GAAP Financial Measures

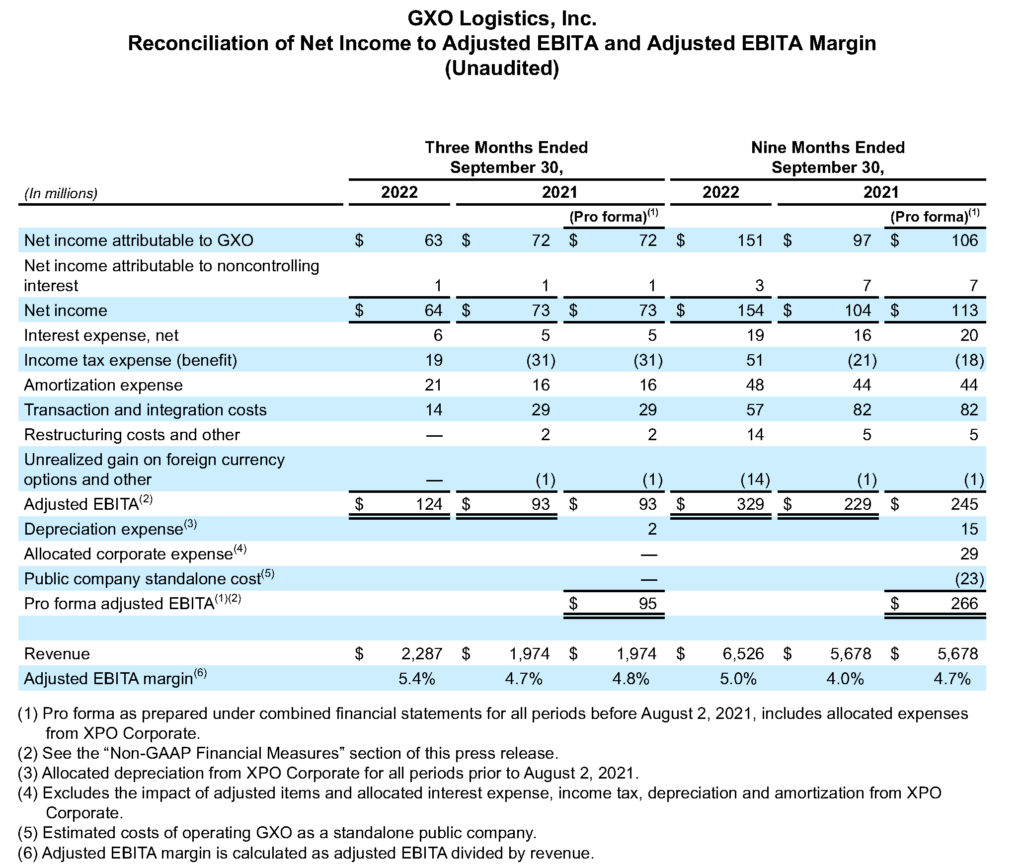

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables below.

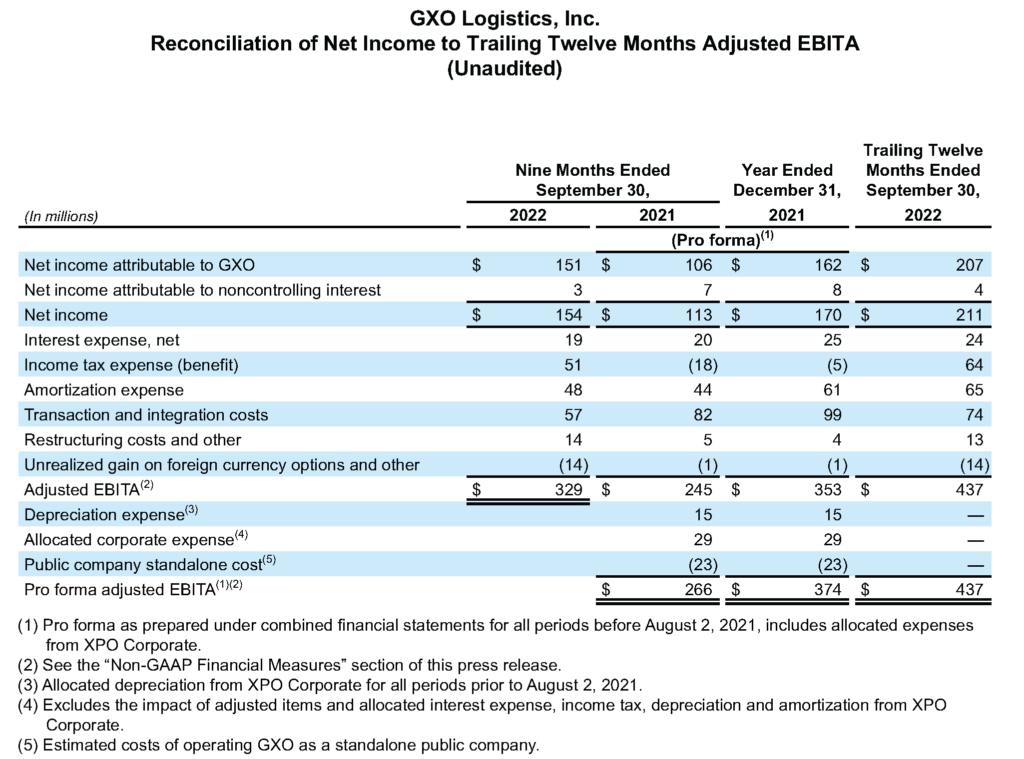

GXO’s non-GAAP financial measures in this press release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), adjusted EBITDA margin, pro forma adjusted EBITDA, pro forma adjusted EBITDA margin, adjusted earnings before interest, taxes and amortization (“adjusted EBITA”), adjusted EBITA margin, pro forma adjusted EBITA, pro forma adjusted EBITA margin, adjusted net income attributable to GXO and adjusted earnings per share (basic and diluted) (“adjusted EPS”), free cash flow, organic revenue, organic revenue growth, net leverage, net debt and return on invested capital (“ROIC”).

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, GXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. GXO’s non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, pro forma adjusted EBITDA, adjusted EBITA, pro forma adjusted EBITA, adjusted net income attributable to GXO and adjusted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the financial tables below. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and separating IT systems. Restructuring costs primarily relate to severance costs associated with business optimization initiatives.

Pro forma adjusted EBITDA and pro forma adjusted EBITA include adjustments for allocated corporate expenses and public company standalone costs. Allocated corporate expenses are those expenses that were allocated to the combined financial statements on a carve-out basis in accordance with U.S. GAAP. Public company standalone costs are estimated costs of operating GXO as a public standalone company following its spin-off from XPO Logistics, Inc. effective as of August 2, 2021 and represents the midpoint of our estimated corporate costs.

We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as net cash provided by operating activities less payment for purchases of property and equipment plus proceeds from sale of property and equipment. We believe that adjusted EBITDA, adjusted EBITDA margin, pro forma adjusted EBITDA, pro forma adjusted EBITDA margin, adjusted EBITA, adjusted EBITA margin, pro forma adjusted EBITA and pro forma adjusted EBITA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income attributable to GXO and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains, which management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets. We believe that organic revenue and organic revenue growth are important measures because they exclude the impact of foreign currency exchange rate fluctuations, revenue from acquired businesses and revenue from deconsolidated operations. We believe that net leverage and net debt are important measures of our overall liquidity position and are calculated by removing cash and cash equivalents from our total debt and net debt as a ratio of our trailing twelve months adjusted EBITDA. We calculate ROIC as our last twelve-month adjusted EBITA, net of income taxes paid divided by invested capital. We believe ROIC provides investors with an important perspective on how effectively GXO deploys capital and use this metric internally as a high-level target to assess overall performance throughout the business cycle.

Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating GXO’s ongoing performance.

With respect to our financial targets for full-year 2022 adjusted EBITDA, organic revenue growth, adjusted diluted EPS, ROIC, and free cash flow, a reconciliation of these non-GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non-GAAP target measures. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statements of income and cash flows prepared in accordance with GAAP, that would be required to produce such a reconciliation.

Declarații prospective

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements, including our 2022 financial targets for organic revenue growth, adjusted diluted EPS, adjusted EBITDA, ROIC, and free cash flow; the expected incremental revenue impact of new customer contracts in 2022 and 2023; the anticipated timing for realizing cost synergies from our acquisition of Clipper Logistics; and our growth expectations for 2023. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by the company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors the company believes are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, the risks discussed in our filings with the SEC and the following: the severity, magnitude, duration and aftereffects of the COVID-19 pandemic and government responses to the COVID-19 pandemic, including vaccine mandates; economic conditions generally; supply chain challenges, including labor shortages; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, and warehouses, to our customers’ demands; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; acquisitions may be unsuccessful or result in other risks or developments that adversely affect our financial condition and results; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our ability to raise debt and equity capital; litigation; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers’ facilities and efforts by labor organizations to organize our employees; risks associated with defined benefit plans for our current and former employees; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; issues related to our intellectual property rights; governmental regulation, including trade compliance laws, as well as changes in international trade policies and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; natural disasters, terrorist attacks or similar incidents; a material disruption of GXO’s operations; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; the impact of potential cyber-attacks and information technology or data security breaches; the inability to implement technology initiatives successfully; the expected benefits of the spin-off, and uncertainties regarding the spin-off, including the risk that the spin-off will not produce the desired benefits; and a determination by the IRS that the distribution or certain related spin-off transactions should be treated as taxable transactions.

Toate declarațiile anticipative prezentate în acest comunicat de presă sunt calificate de aceste avertismente și nu există nicio garanție că rezultatele sau evoluțiile reale anticipate de noi se vor realiza sau, chiar dacă se vor realiza în mod substanțial, că vor avea consecințele sau efectele așteptate asupra noastră sau asupra activității sau operațiunilor noastre. Declarațiile anticipative prezentate în acest comunicat de presă se referă doar la data prezentului comunicat și nu ne asumăm nicio obligație de a actualiza declarațiile anticipative pentru a reflecta evenimente sau circumstanțe ulterioare, modificări ale așteptărilor sau apariția unor evenimente neanticipate, cu excepția cazului în care acest lucru este cerut de lege.

Persoane de contact

Click here to download this press release in PDF format.