Zajímavé události

- First quarter revenue of $2.1 billion, up 14% year-over-year; including organic revenue growth1 of 19%; net income attributable to GXO of $37 million; and adjusted EBITDA[1] of $155 million; 167% growth in diluted EPS and 59% growth in adjusted diluted EPS1

- GXO raises full-year 2022 guidance and introduces adjusted diluted EPS1 guidance: 2022 organic revenue growth1 raised to 11-15% year-over-year; full-year adjusted diluted EPS1 guidance of $2.70-$2.90 implying growth of 29-39%

Business Highlights

- Record first quarter new business wins; over $1 billion of incremental revenue contracted for 2022, equivalent to 13% of 2021 revenue

- Incremental revenue of approximately $217 million already contracted for 2023

- Robust sales pipeline of $2.5 billion, 20% increase year-over-year

- Revenue retention rate in the mid-to-high 90s since spin

- Inaugural ESG report released, showing 24% decrease in greenhouse gas intensity by revenue in 2021

GXO Logistics, Inc. (NYSE: GXO) today announced results for the first quarter ended March 31, 2022.

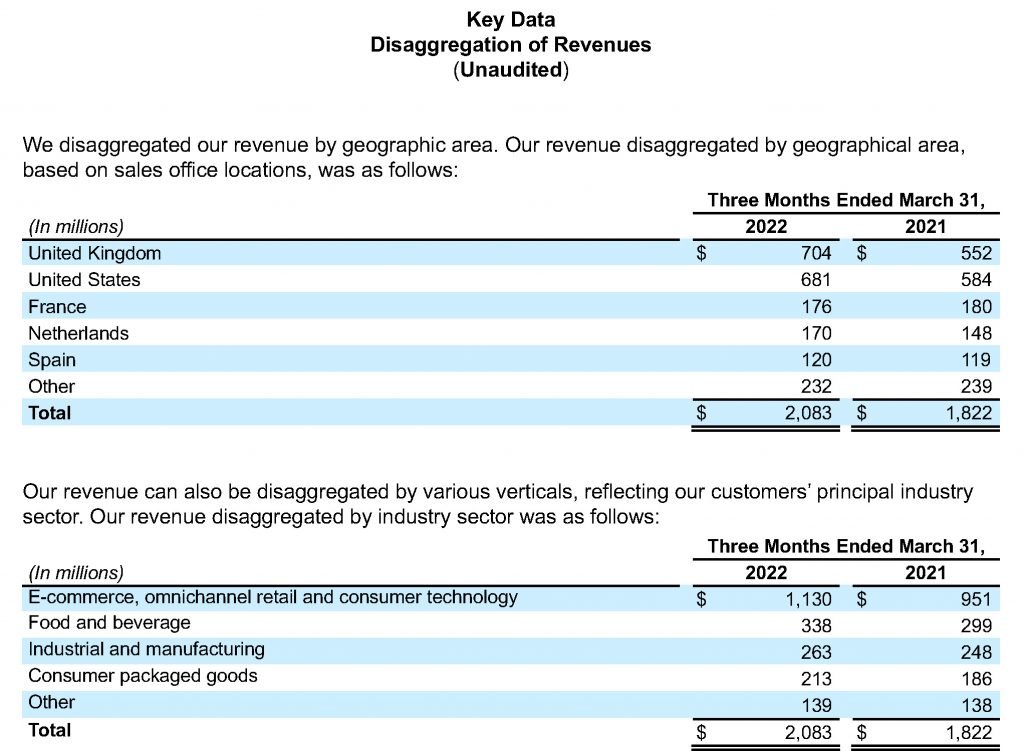

Malcolm Wilson, Chief Executive Officer of GXO, said, “Our stellar top- and bottom-line performance this quarter and record new business wins are a testament to the value of GXO’s game-changing solutions, the strength of our contractual business model and the accelerating demand for first-time outsourcing, especially from e-commerce and omnichannel customers.

“In today’s environment, where supply chains are increasingly complex and require greater scale, GXO’s solutions are helping maximize our customers’ speed to market and profitability, while also reducing their environmental impact. Our ability to provide our customers with technologically advanced warehousing solutions and exceptional service to optimize their inventories effectively is more critical now than ever.

“Across our business in the first quarter, we saw solid volumes and growth in all of our verticals. Looking to the remainder of 2022 and beyond, we continue to benefit from multi-year revenue visibility, exceptional growth opportunities with new and existing customers, and a predictable, contractual business model.

“Our new business wins, combined with our record sales pipeline and continued high revenue retention rate, allow us to raise our 2022 organic revenue growth guidance to 11-15% and introduce an adjusted diluted EPS guidance of $2.70-$2.90 for 2022 implying growth of between 29% and 39%.”

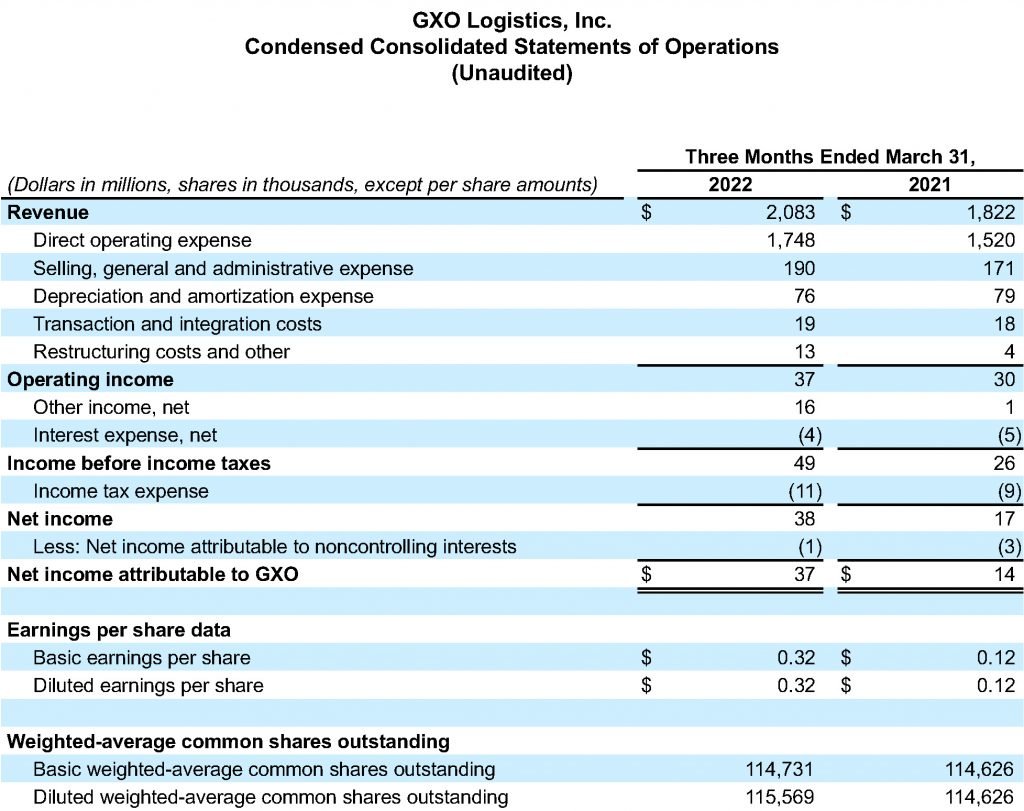

First Quarter 2022 Results

Revenue increased to $2.1 billion, compared with $1.8 billion for the first quarter 2021. Net income attributable to GXO was $37 million, compared with $14 million for the first quarter 2021. GXO reported pro forma net income attributable to GXO of $18 million for the first quarter 2021. Diluted earnings per share was $0.32, compared with $0.12 for the first quarter 2021.

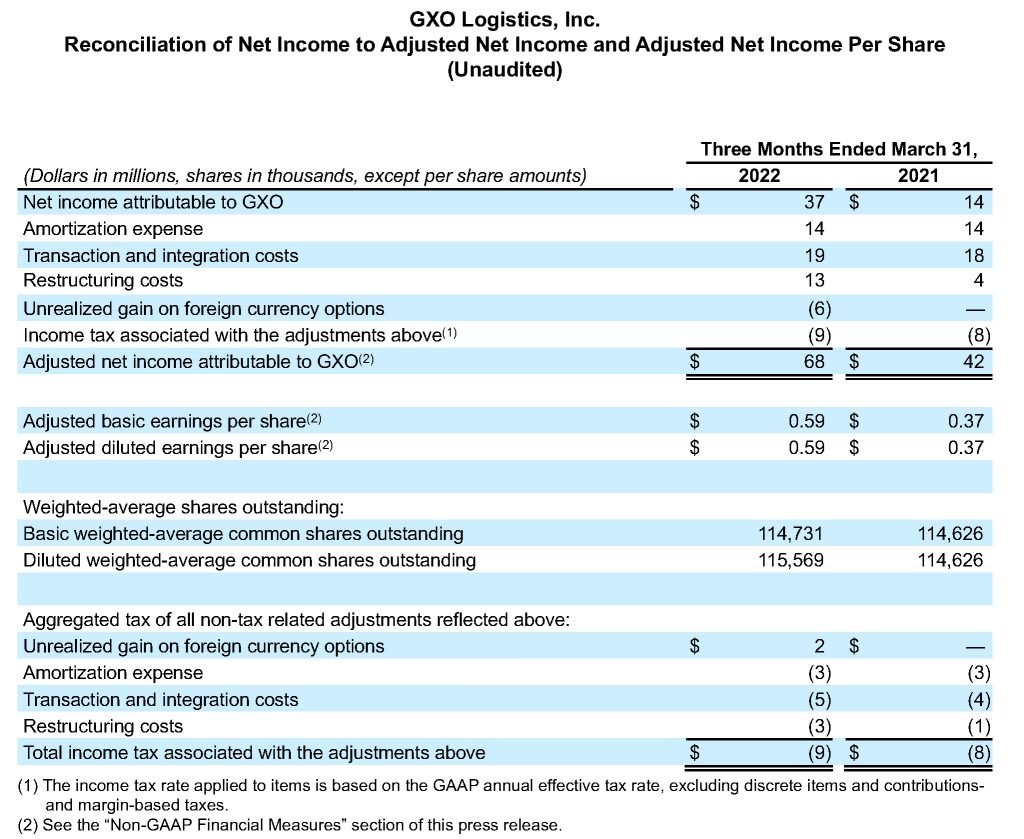

Adjusted net income attributable to GXO1 was $68 million, compared with $42 million for the first quarter 2021. Adjusted diluted earnings per share1 was $0.59, compared with $0.37 for the first quarter 2021.

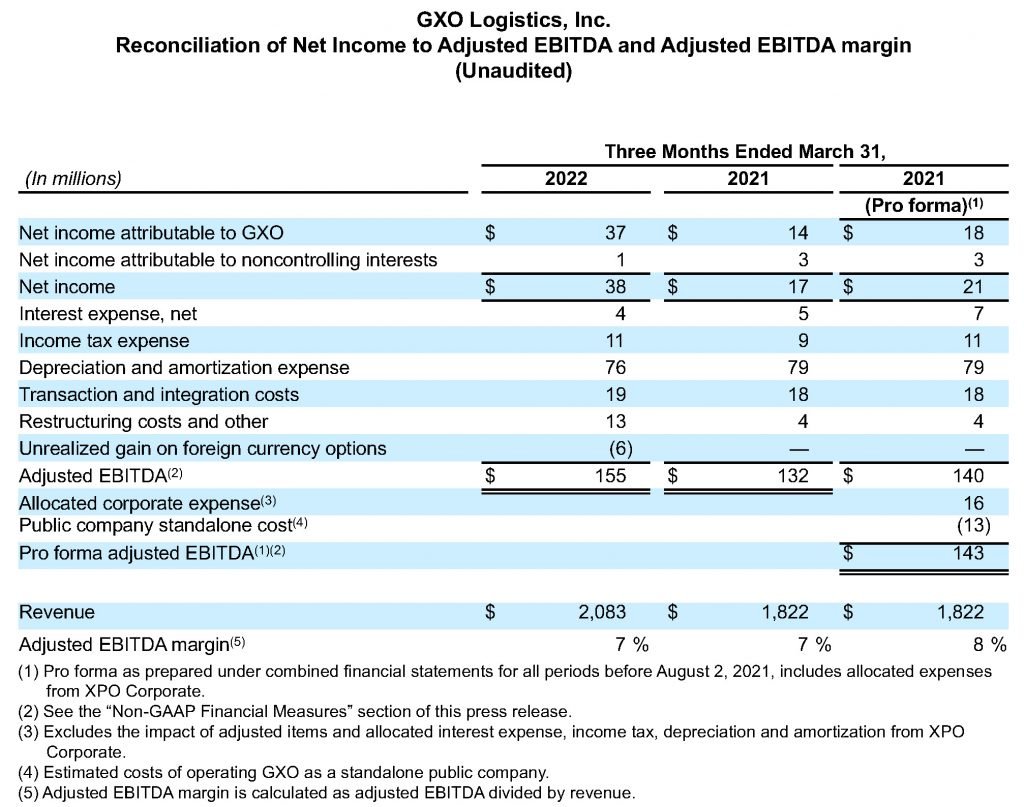

Adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA1”) increased to $155 million from $132 million in the first quarter 2021. GXO reported pro forma adjusted EBITDA1 of $143 million for the first quarter 2021.

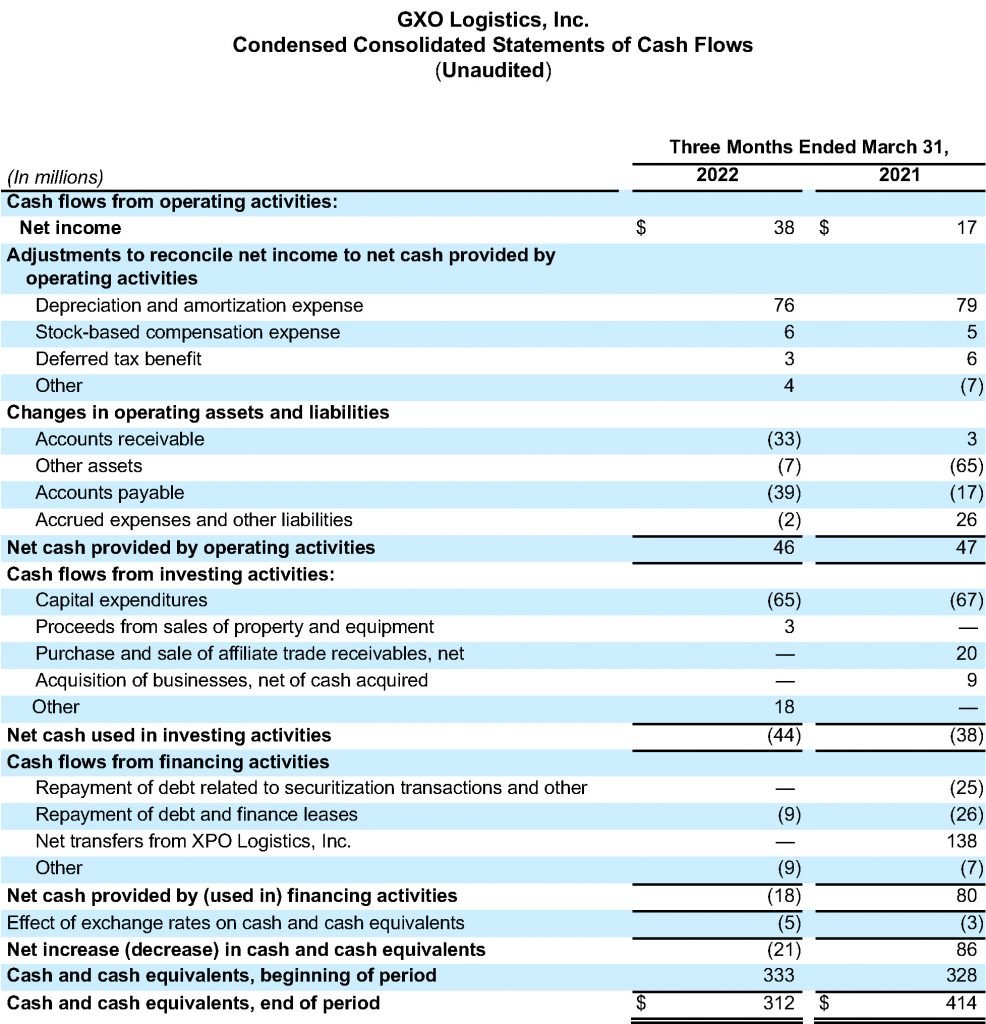

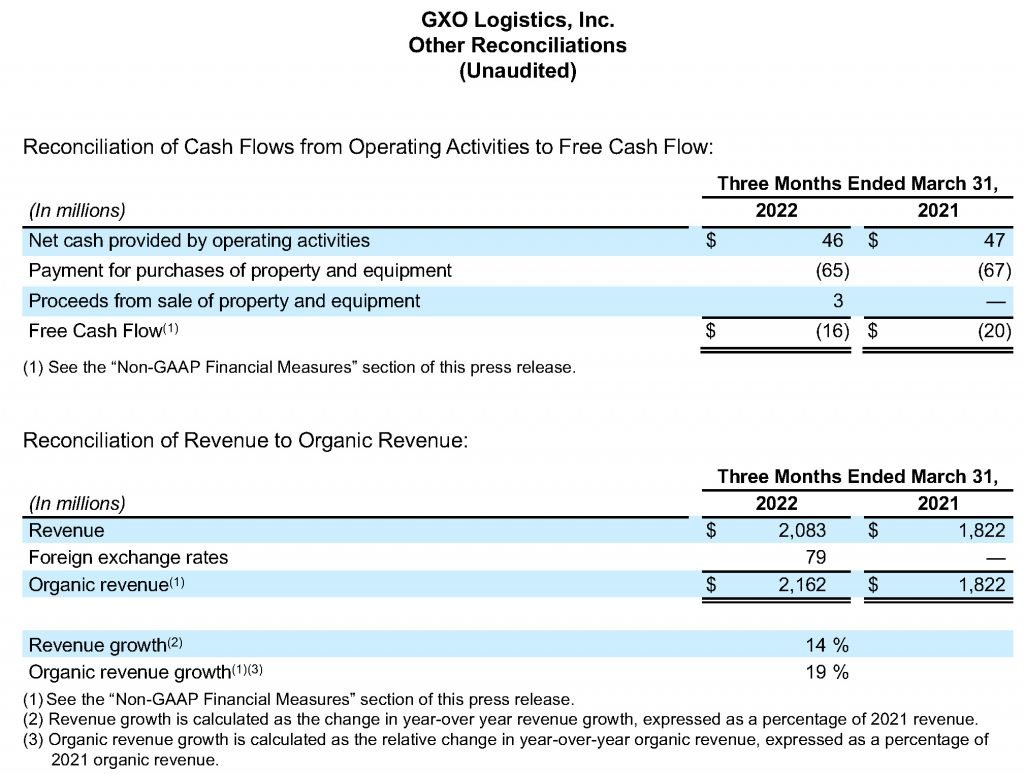

GXO generated $46 million of cash flow from operations, compared with $47 million for the first quarter 2021. In the first quarter 2022, GXO used $16 million of free cash flow1 compared to $20 million for the first quarter 2021.

During the first quarter 2022, GXO won new customer contracts expected to contribute $344 million in annualized revenue. These wins are expected to generate $192 million in incremental revenue in 2022. Reflecting these strong new wins, we are raising our revenue guidance to 11-15% organic growth in 2022. The new customer contracts GXO won through the first quarter 2022 are expected to contribute $217 million in incremental revenue in 2023.

2022 Guidance Update

GXO raises full-year 2022 guidance, as follows:

- Organic revenue growth1 raised to 11%-15% (previously 8%-12%)

- Adjusted diluted earnings per share1 of $2.70-$2.90 (new metric)

- Adjusted EBITDA1 of $707 million to $742 million

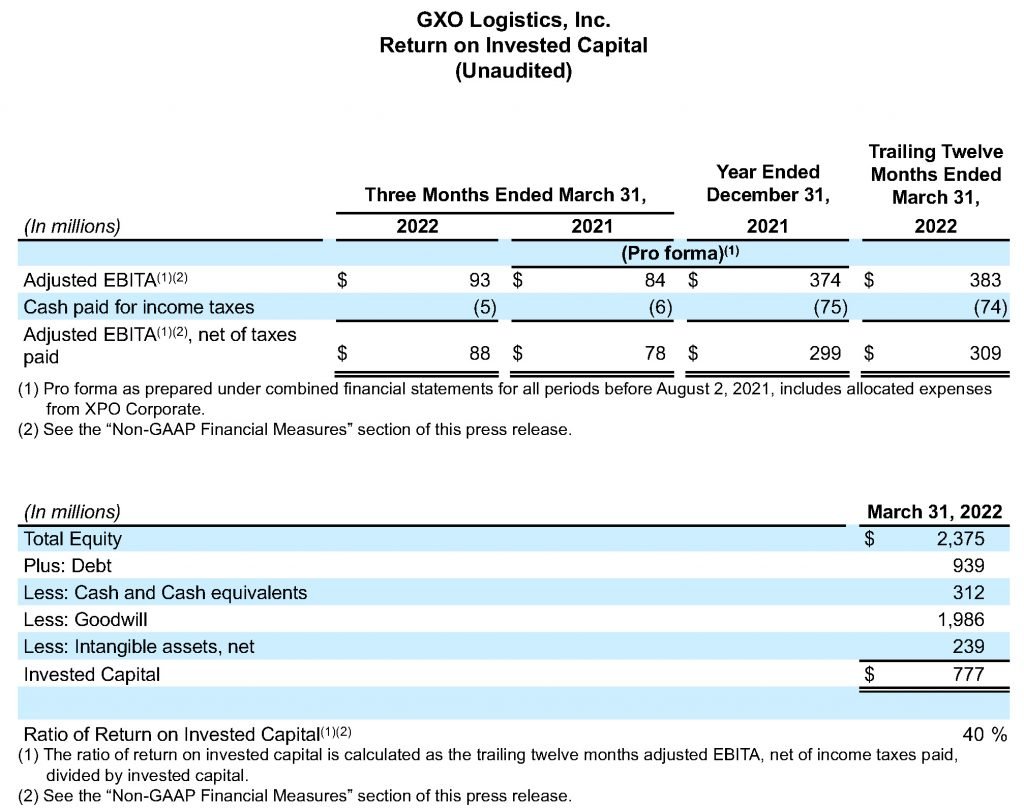

- Return on invested capital1 greater than 30%

- Free cash flow1 of approximately 30% of adjusted EBITDA1

- Depreciation and amortization between $260 million and $280 million

- Net capital expenditures at approximately 3% of sales

The 2022 targets exclude the expected benefits from the pending acquisition of Clipper Logistics plc and assumes constant exchange rates.

GXO Long-Term Guidance

GXO intends to issue long-term financial targets at its Investor Day in the second half of 2022.

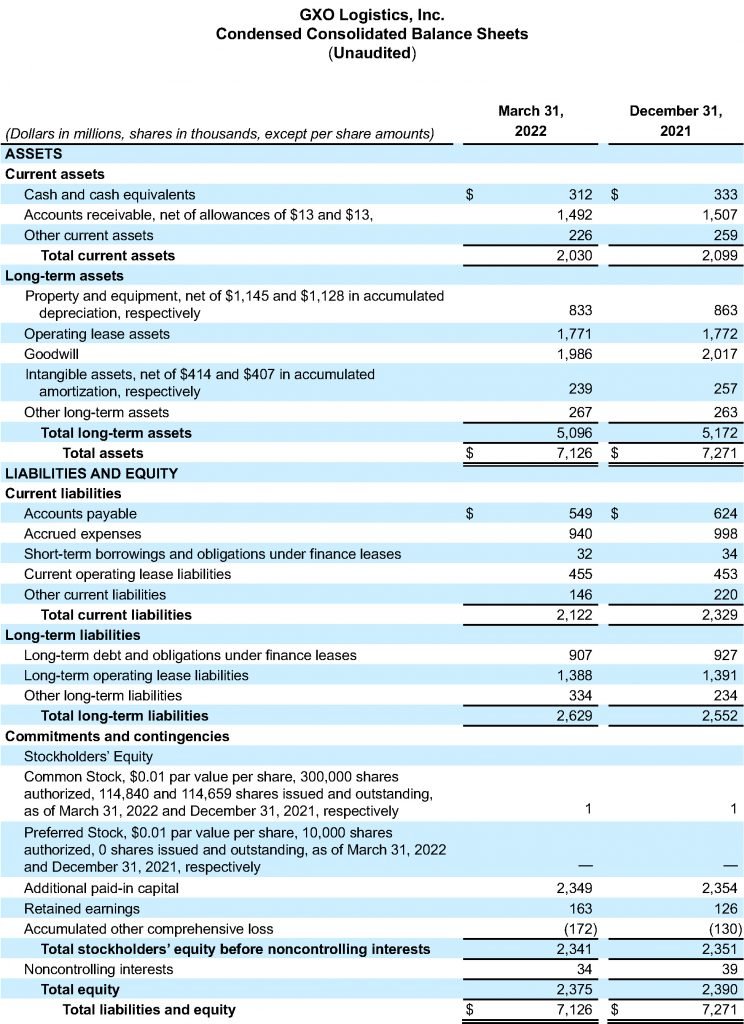

Liquidity Position

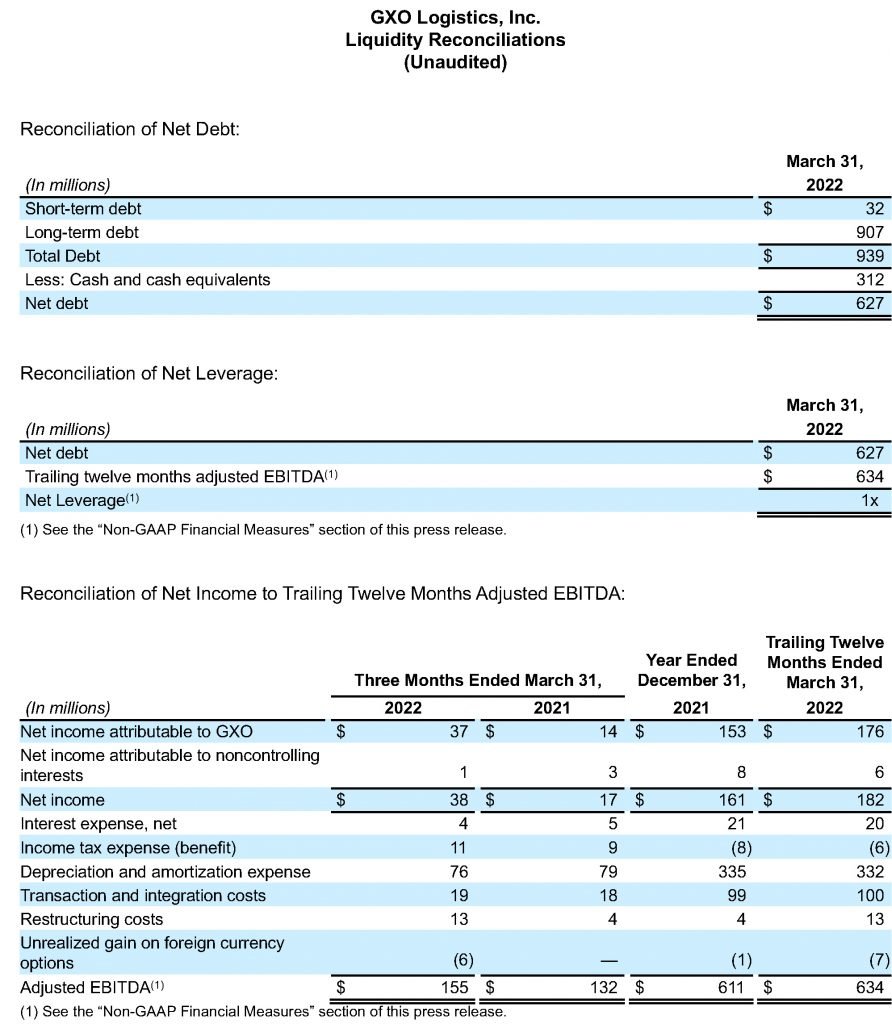

As of March 31, 2022, GXO had approximately $1.1 billion of total liquidity and $939 million of total debt. The company’s net leverage1 was 1x, calculated as net debt1 of $627 million, divided by the trailing twelve months adjusted EBITDA1 of $634 million for the period ended March 31, 2022.

Conference Call

GXO will hold a conference call on Thursday, May 5, 2022, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 877-407-8029; international callers dial +1 201-689-8029. Conference ID: 13728651. A live webcast of the conference will be available on the Investor Relations area of the company’s website, investors.gxo.com. The conference will be archived until May 19, 2022. To access the replay by phone, call toll-free (from US/Canada) 877-660-6853; international callers dial +1 201-612-7415. Use participant passcode 13728651.

O společnosti GXO Logistics

GXO Logistics, Inc. (NYSE: GXO) je největším světovým poskytovatelem smluvní logistiky na světě, který těží z rychlého růstu e-commerce, automatizace a outsourcingu. Společnost GXO s přibližně 130 tisíci zaměstnanci působí ve více než 950 logistických centrech o celkové ploše čítající téměř 20 milionů metrů čtverečních. Společnost spolupracuje s předními světovými tzv. blue chip společnostmi na zvládnutí složitých logistických výzev pomocí technologicky vyspělých řešení dodavatelského řetězce a velkých projektů v oblasti e-commerce. Sídlo společnosti GXO je ve městě Greenwich, ve státě Connecticut, v USA. Navštivte LinkedIn, Twitter, Facebook, Instagram a YouTube.

Non-GAAP Financial Measures

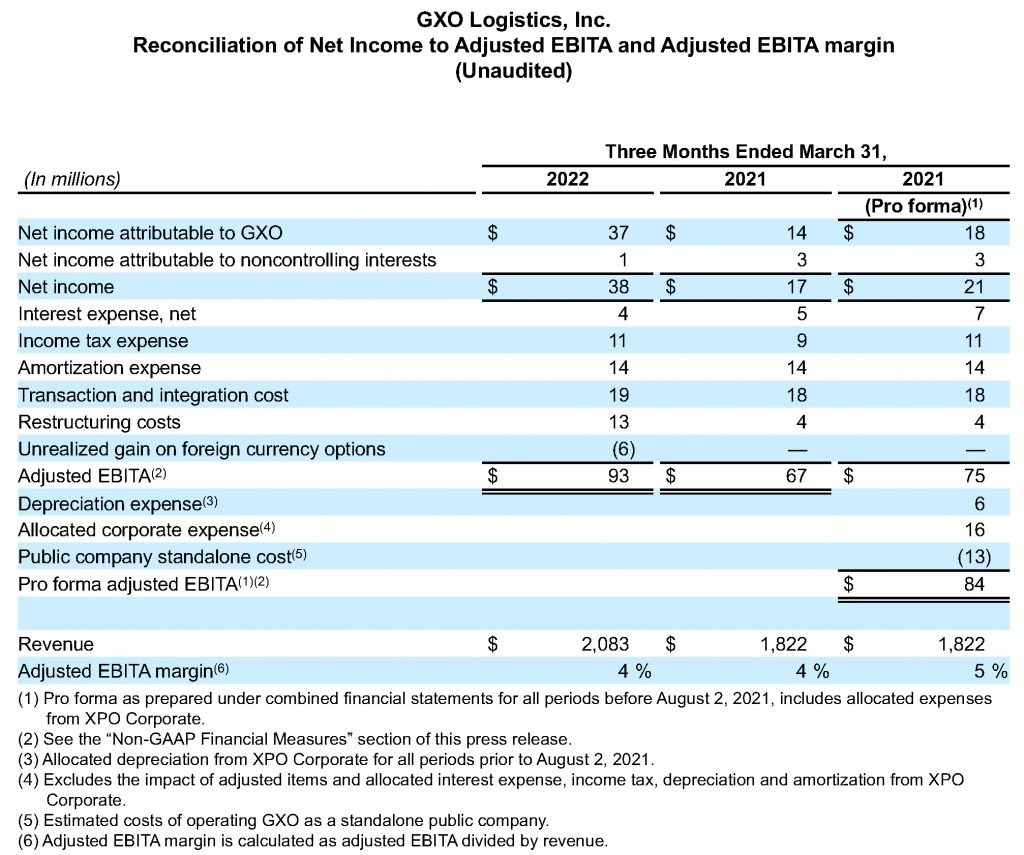

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables below.

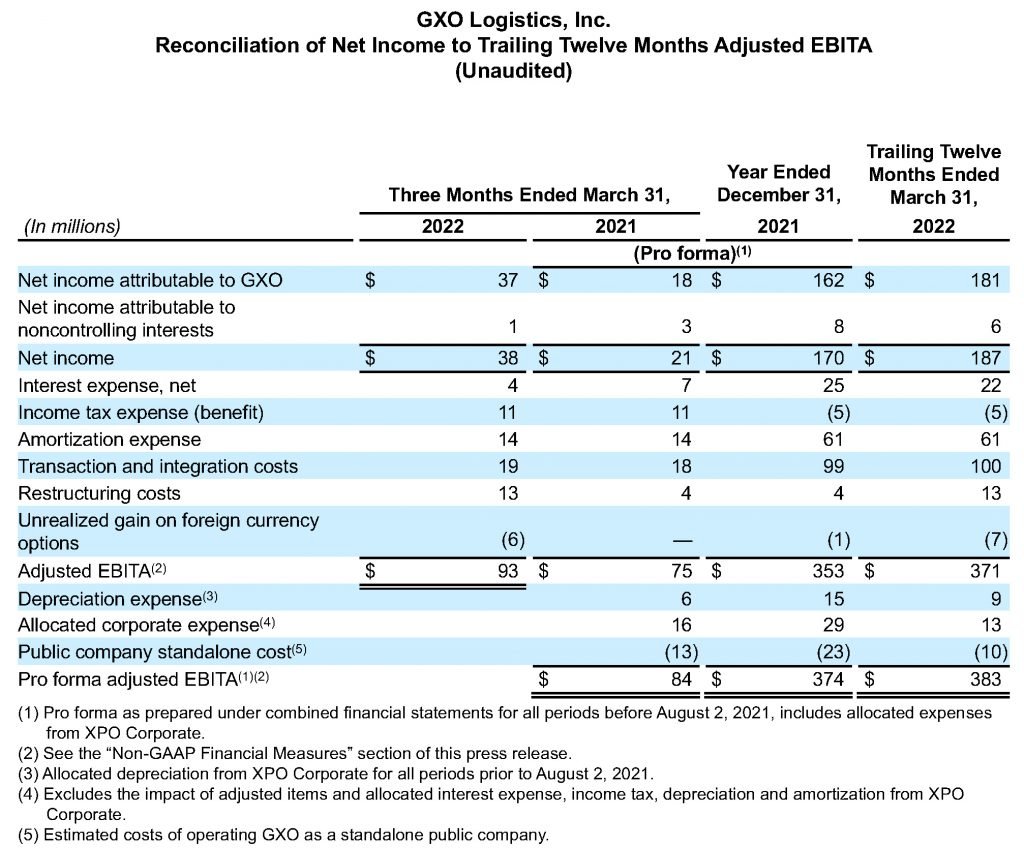

GXO’s non-GAAP financial measures in this press release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), adjusted EBITDA margin, pro forma adjusted EBITDA, pro forma adjusted EBITDA margin, adjusted earnings before interest, taxes and amortization (“adjusted EBITA”), adjusted EBITA margin, pro forma adjusted EBITA, pro forma adjusted EBITA margin, adjusted net income attributable to GXO and adjusted earnings per share (basic and diluted) (“adjusted EPS”), free cash flow, organic revenue, organic revenue growth, net leverage, net debt and return on invested capital (“ROIC”).

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, GXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. GXO’s non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, pro forma adjusted EBITDA, adjusted EBITA, pro forma adjusted EBITA, adjusted net income attributable to GXO and adjusted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the financial tables below. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and separating IT systems. Restructuring costs primarily relate to severance costs associated with business optimization initiatives.

Pro forma adjusted EBITDA and pro forma adjusted EBITA include adjustments for allocated corporate expenses and public company standalone costs. Allocated corporate expenses are those expenses that were allocated to the combined financial statements on a carve-out basis in accordance with U.S. GAAP. Public company standalone costs are estimated costs of operating GXO as a public standalone company following its spin-off from XPO Logistics, Inc. effective as of August 2, 2021 and represents the midpoint of our estimated corporate costs.

We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as net cash provided by operating activities less payment for purchases of property and equipment plus proceeds from sale of property and equipment. We believe that adjusted EBITDA, adjusted EBITDA margin, pro forma adjusted EBITDA, adjusted EBITA, adjusted EBITA margin, pro forma adjusted EBITA and pro forma adjusted EBITA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income attributable to GXO and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains, which management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets. We believe that organic revenue and organic revenue growth are important measures because they exclude the impact of foreign currency exchange rate fluctuations and revenue from acquired businesses. We believe that net leverage and net debt are important measures of our overall liquidity position and are calculated by removing cash and cash equivalents from our total debt and net debt as a ratio of our trailing twelve months adjusted EBITDA. We calculate ROIC as our trailing twelve months adjusted EBITA, net of income taxes paid divided by invested capital. We believe ROIC provides investors with an important perspective on how effectively GXO deploys capital and uses this metric internally as a high-level target to assess overall performance throughout the business cycle.

Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating GXO’s ongoing performance.

With respect to our financial targets for full-year 2022 adjusted EBITDA, organic revenue growth, adjusted diluted EPS, ROIC and free cash flow, a reconciliation of these non-GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non-GAAP target measures. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statements of income and cash flows prepared in accordance with GAAP, that would be required to produce such a reconciliation.

Výhledová prohlášení

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements, including our 2022 financial targets for organic revenue growth, adjusted diluted EPS, adjusted EBITDA, ROIC, free cash flow, depreciation and amortization expense and net capital expenditures; and the expected incremental revenue impact of new customer contracts in 2022 and 2023. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by the company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors the company believes are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, the risks discussed in our filings with the SEC and the following: the severity, magnitude, duration and aftereffects of the COVID-19 pandemic and government responses to the COVID-19 pandemic, including vaccine mandates; economic conditions generally; supply chain challenges, including labor shortages; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, and warehouses, to our customers’ demands; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; acquisitions may be unsuccessful or result in other risks or developments that adversely affect our financial condition and results; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our ability to raise debt and equity capital; litigation; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers’ facilities and efforts by labor organizations to organize our employees; risks associated with defined benefit plans for our current and former employees; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; issues related to our intellectual property rights; governmental regulation, including trade compliance laws, as well as changes in international trade policies and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; natural disasters, terrorist attacks or similar incidents; a material disruption of GXO’s operations; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; the impact of potential cyber-attacks and information technology or data security breaches; the inability to implement technology initiatives successfully; the expected benefits of the spin-off, and uncertainties regarding the spin-off, including the risk that the spin-off will not produce the desired benefits; and a determination by the IRS that the distribution or certain related spin-off transactions should be treated as taxable transactions.

All forward-looking statements set forth in this press release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this press release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

[1] For definitions of non-GAAP measures see the “Non-GAAP Financial Measures” section in this press release.

Kontakty

Click here to download this press release in PDF format.