Tisková zpráva

GXO releases preliminary first quarter 2024 results

Greenwich, USA | Duben 24, 2024

Company reiterates 2024 guidance; updates long-term financial targets

GXO Logistics, Inc. (NYSE: GXO), the world’s largest pure-play contract logistics provider, today announced selected preliminary financial results for the quarter ended March 31, 2024. The company also reiterated its outlook for the full year 2024 on a standalone basis, updated the full-year 2024 guidance to include the expected impact of the Wincanton acquisition and revised its 2027 financial targets in advance of its first quarter 2024 earnings announcement and conference call.

Malcolm Wilson, Chief Executive Officer of GXO, said, “Our solid preliminary first quarter results reflect the improving trend we noted earlier this year, and we anticipate continued sequential organic growth throughout 2024. As a result, we are reiterating our full-year 2024 guidance.

“Our pace of new business wins is accelerating, with a 55% increase year over year in first quarter wins. We continue to see a strong outsourcing trend, with more than half of our wins in the quarter coming from customers outsourcing to GXO or partnering with GXO for the first time, and our pipeline has increased to $2.2 billion as of the end of the quarter. Customers are continuing to turn to GXO to improve service, drive efficiencies, and lower costs throughout their supply chains.

“We’re also taking this opportunity to update the long-term guidance provided at our Investor Day in January 2023. Our revised targets reflect our performance in 2023 and guidance for 2024, which assumes the gradual recovery of consumer demand for physical goods. Additionally, following the recent approval by Wincanton shareholders of our planned acquisition, the expected impact of this transaction is also embedded in our new 2027 plan.

“Looking ahead, we’re enhancing our position to capture more of the growing outsourcing opportunity. We are investing in our sales organization and strategically increasing the number of higher-margin, longer-duration automation contracts across our global footprint. We are also diversifying our business across geographies, including Germany, and verticals, particularly in beauty and luxury markets worldwide, as well as industrials and aerospace in Europe. These actions, coupled with the normalizing of consumer goods spending, underpin our confidence in our long-term growth framework to drive significant shareholder value over the long term.”

Preliminary First Quarter 2024 Results

Based on information available as of April 24, 2024, the company currently expects to report for the first quarter ended March 31, 20241:

- Revenue of approximately $2.5 billion;

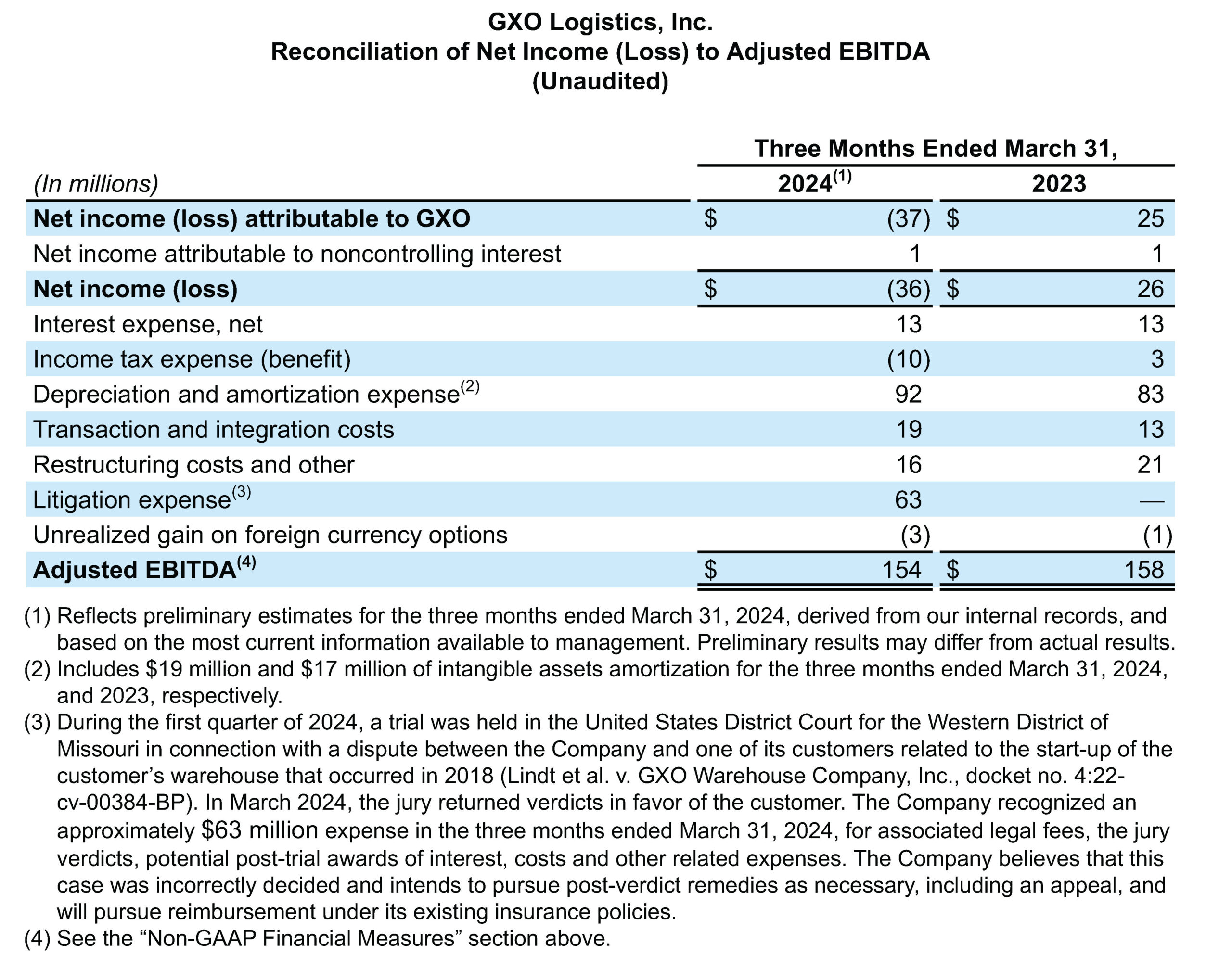

- Net loss of approximately $36 million, primarily driven by a $63 million expense associated with legacy litigation;

- Adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA2”) of approximately $154 million;

- Cash and cash equivalents of approximately $423 million;

- Long-term debt, including current debt of $26 million, of approximately $1,637 million; and

- New business wins in the quarter of approximately $250 million, including new business with Boeing, Guess, Michelin and WH Smith.

Full-Year 2024 Guidance

The company reiterated its outlook for the full year 2024 on a standalone basis and updated its guidance to include the expected impact of the Wincanton acquisition, which remains subject to the satisfaction of customary conditions.

Standalone basis (unchanged):

- Organic revenue growth2 of 2% to 5%;

- Adjusted EBITDA2 of $760 million to $790 million;

- Adjusted diluted EPS2 of $2.70 to $2.90; and

- Free cash flow conversion2 of 30% to 40% of adjusted EBITDA2.

Including expected impact of Wincanton acquisition, subject to the satisfaction of customary conditions:

- Organic revenue growth2 of 2% to 5%;

- Adjusted EBITDA2 of $805 million to $835 million;

- Adjusted diluted EPS2 of $2.73 to $2.93; and

- Free cash flow conversion2 of 30% to 40% of adjusted EBITDA2.

Updated 2027 Financial Targets

The Company updated its 2027 financial targets, first outlined as part of its January 2023 Investor Day presentation, including expected impact of Wincanton acquisition, as follows:

- Organic revenue CAGR (2024-2027)2,3 of approximately 10%, to approximately $15.5 billion to $16.0 billion of revenue;

- Approximately 15% adjusted EBITDA CAGR (2024-2027)2,3, to approximately $1.25 billion to $1.30 billion of adjusted EBITDA2;

- Adjusted diluted EPS CAGR (2024-2027)2,3 of more than 15%;

- Free cash flow conversion of greater than 30% of adjusted EBITDA (2024-2027)2; and

- Operating return on invested capital2 of more than 30%.

The company posted a supplementary presentation today on GXO’s Investor Relations website at investors.gxo.com.

First Quarter 2024 Conference Call

GXO will hold its first quarter 2024 conference call and webcast on Wednesday, May 8, 2024 at 8:30 a.m. Eastern Time. The company’s results will be released after market close on Tuesday, May 7, 2024, and made available at that time on investors.gxo.com.

O společnosti GXO Logistics

GXO Logistics, Inc. (NYSE: GXO) je největším světovým poskytovatelem smluvní logistiky na světě, který těží z rychlého růstu e-commerce, automatizace a outsourcingu. Společnost GXO s přibližně 130 tisíci zaměstnanci působí ve více než 950 logistických centrech o celkové ploše čítající téměř 20 milionů metrů čtverečních. Společnost spolupracuje s předními světovými tzv. blue chip společnostmi na zvládnutí složitých logistických výzev pomocí technologicky vyspělých řešení dodavatelského řetězce a velkých projektů v oblasti e-commerce. Sídlo společnosti GXO je ve městě Greenwich, ve státě Connecticut, v USA. Navštivte

- See the “Preliminary Financial Information” section in this press release.

- For definitions of non-GAAP measures see the “Non-GAAP Financial Measures” section in this press release.

- Compound Annual Growth Rate (CAGR).

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial table below.

GXO’s non-GAAP financial measures in this press release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), adjusted EBITDA CAGR, organic revenue, organic revenue growth, organic revenue CAGR, adjusted diluted earnings per share (“adjusted diluted EPS”), adjusted diluted EPS CAGR, free cash flow, free cash flow conversion, and operating return on invested capital (“ROIC”).

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, GXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. GXO’s non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA and adjusted diluted EPS includes adjustments for transaction and integration costs, litigation expenses as well as restructuring costs and other adjustments as set forth in the financial table below. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities), and certain costs related to integrating and separating IT systems. Litigation expenses primarily relate to the settlement of ongoing legal matters. Restructuring costs primarily relate to severance costs associated with business optimization initiatives.

We believe that adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses.

We believe that organic revenue and organic revenue growth are important measures because they exclude the impact of foreign currency exchange rate fluctuations, revenue from acquired businesses and revenue from deconsolidated operations.

We believe that adjusted diluted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains, which management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets.

We believe that free cash flow and free cash flow conversion are important measures of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as cash flows from operations less capital expenditures plus proceeds from sale of property and equipment. We calculate free cash flow conversion as free cash flow divided by adjusted EBITDA, expressed as a percentage.

We believe ROIC provides investors with an important perspective on how effectively GXO deploys capital and use this metric internally as a high-level target to assess overall performance throughout the business cycle.

Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating GXO’s ongoing performance.

With respect to our updated full-year 2024 guidance and our updated 2027 financial targets, a reconciliation of these non-GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non-GAAP target measures. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statements of income and cash flows prepared in accordance with GAAP, that would be required to produce such a reconciliation.

Preliminary Financial Information

The preliminary financial results for the quarter ended March 31, 2024 included in this press release are preliminary and unaudited and reflect our estimated financial results as of and for the three months ended March 31, 2024. In preparing this information, management made a number of complex and subjective judgments and estimates about the appropriateness of certain reported amounts and disclosures. The preliminary financial results included in this press release have been prepared by, and are the responsibility of, our management. Our actual financial results for the first quarter of 2024 have not yet been finalized by management. In addition, the preliminary financial results presented above have not been audited, reviewed, or compiled by our independent registered public accounting firm, KPMG LLP. Accordingly, KPMG LLP does not express an opinion or any other form of assurance with respect thereto and assumes no responsibility for, and disclaims any association with, this information. These results are not a comprehensive statement of all financial results as of and for the three months ended March 31, 2024. We are required to consider all available information through the finalization of our financial statements and their possible impact on our financial conditions and results of operations for the period, including the impact of such information on the complex judgments and estimates referred to above. As a result, subsequent information or events may lead to material differences between the information about the results of operations described herein and the results of operations described in our subsequent quarterly report. Accordingly, you should not place undue reliance on these preliminary financial results.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements, including our continued sequential organic growth throughout 2024, the gradual recovery of consumer demand for physical goods, our preliminary expected results for the quarter ended March 31, 2024, our updated fiscal year 2024 guidance, our fiscal year 2027 financial targets and the expected closing of the Wincanton acquisition. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by the company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors the company believes are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, the risks discussed in our filings with the SEC and the following: economic conditions generally; supply chain challenges, including labor shortages; competition and pricing pressures; GXO and/or Wincanton’s ability to align GXO and/or Wincanton’s investments in capital assets, including equipment, service centers and warehouses, to their respective customers’ demands; GXO and/or Wincanton’s ability to successfully integrate and realize anticipated benefits, synergies, cost savings and profit improvement opportunities with respect to acquired companies, including the acquisition of Wincanton; acquisitions may be unsuccessful or result in other risks or developments that adversely affect GXO and/or Wincanton’s financial condition and results; GXO and/or Wincanton’s ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; GXO and/or Wincanton’s indebtedness; GXO and/or Wincanton’s ability to raise debt and equity capital; litigation; labor matters, including GXO and/or Wincanton’s ability to manage its subcontractors, and risks associated with labor disputes at GXO and/or Wincanton’s customers’ facilities and efforts by labor organizations to organize its employees; risks associated with defined benefit plans for GXO and/or Wincanton’s current and former employees; GXO and/or Wincanton’s ability to attract or retain necessary talent; the increased costs associated with labor; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; fluctuations in customer confidence and spending; issues related to GXO and/or Wincanton’s intellectual property rights; governmental regulation, including environmental laws, trade compliance laws, as well as changes in international trade policies and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; natural disasters, terrorist attacks or similar incidents; damage to GXO and/or Wincanton’s reputation; a material disruption of GXO and/or Wincanton’s operations; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; failure in properly handling the inventory of GXO and/or Wincanton’s customers; the impact of potential cyber-attacks and information technology or data security breaches; and the inability to implement technology initiatives or business systems successfully; GXO and/or Wincanton’s ability to achieve Environmental, Social and Governance goals; and a determination by the IRS that the distribution or certain related spin-off transactions should be treated as taxable transactions. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Such forward-looking statements should therefore be construed in the light of such factors.

All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

Kontakty

Click here to download this press release in PDF format.